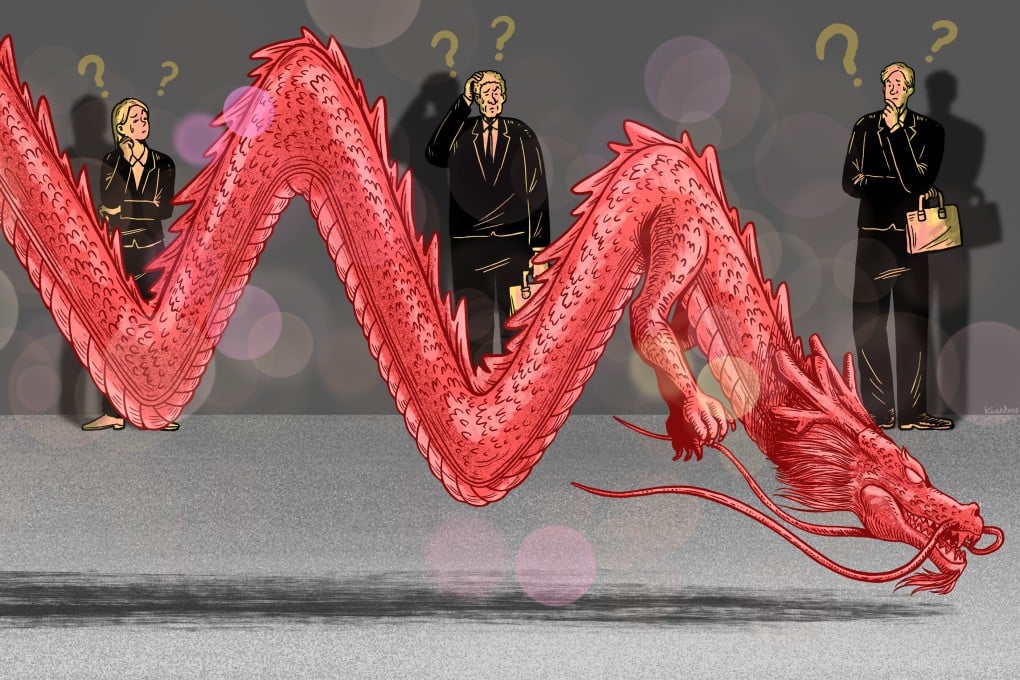

Is China uninvestable or irreplaceable? Foreign investors ponder rising risks vs rewards of world’s second-largest economy

- China has been on a charm offensive to woo foreign investment, but direct investment liabilities fell for the first time in the third quarter, suggesting they are easing off

- De-risking, geopolitical tensions and tightening regulation have turned some investors away, while others still see the potential in China’s market of 1.4 billion people

After eight years of operation in northern China, Japanese multinational Teijin decided to sell its plant specialising in vehicle components in Hebei province this summer.

Explained as a move to “concentrate our resources on our base in North America”, the deal meant Teijin would withdraw entirely from the automotive composites business in China, the company said in a statement in August.

Teijin’s curtailment of its presence in China came just months after Beijing rolled out the red carpet for global executives in an attempt to woo back foreign firms following its break from disruptive zero-Covid measures in December last year.

Now as the year draws to an end, more foreign investors may be pondering a similar question as they look into the years ahead: is China uninvestable or irreplaceable?

When the Chinese economy was growing 7, 8, 9 per cent a year, there was something in it pretty much for everyone

While the answer differs from industry to industry and company to company, a general trend is that foreign enterprises are divesting their China operations.

But it is at a pace that may take a long time to meaningfully erode investment in the world’s second-largest economy, according to business executives and observers.