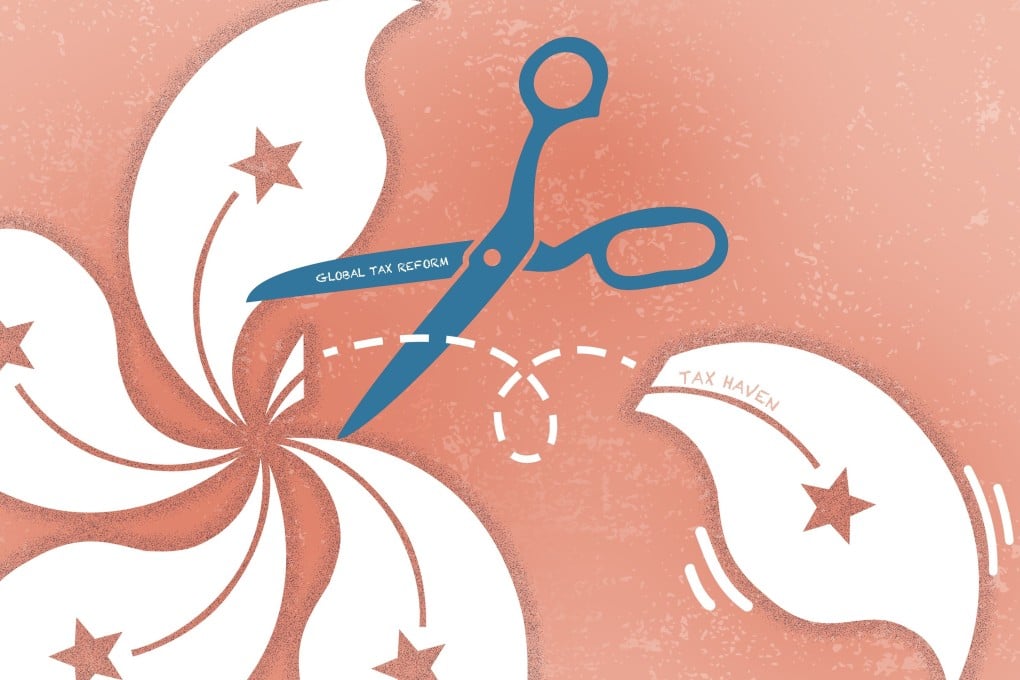

Could Hong Kong’s status as a business hub be threatened under global minimum tax reform?

- Hong Kong’s headline tax rate is 16.5 per cent, but various concessions allow companies to lower their effective rate to below 15 per cent

- Although not a major destination for tax-shy firms in the tech industry, the impact of a proposed tax floor on the city remains unclear

Hong Kong’s low tax rate has been a major incentive for American businessman Nicholas Appel to live and work in the city for the past 25 years.

But along with challenges like the city’s high cost of living, the prospect of higher taxes under a minimum global corporate tax rate is one more reason to wonder whether it is worth staying.

“We really love Hong Kong but it’s not a sustainable place to live in if you don’t have income to support it,” Appel said. “If the profitability of a business as a result of a change in taxes were to become negative to a point of not making sense, then we wouldn’t think twice about staying.”

Many analysts say Hong Kong’s advantages – proximity to mainland businesses, a robust legal system and its own freely convertible currency – will continue to outweigh the disadvantages. The city remains the key conduit for capital flows into and out of mainland China, accounting for about 70 per cent of the total.

But generous perks for foreign businesses have seen Hong Kong gain a reputation as Asia’s No 1 tax haven, and it remains unclear how the global reform will affect the city’s tax environment.