Opinion | To avoid an economic meltdown, China must not repeat America’s mistakes of 2008

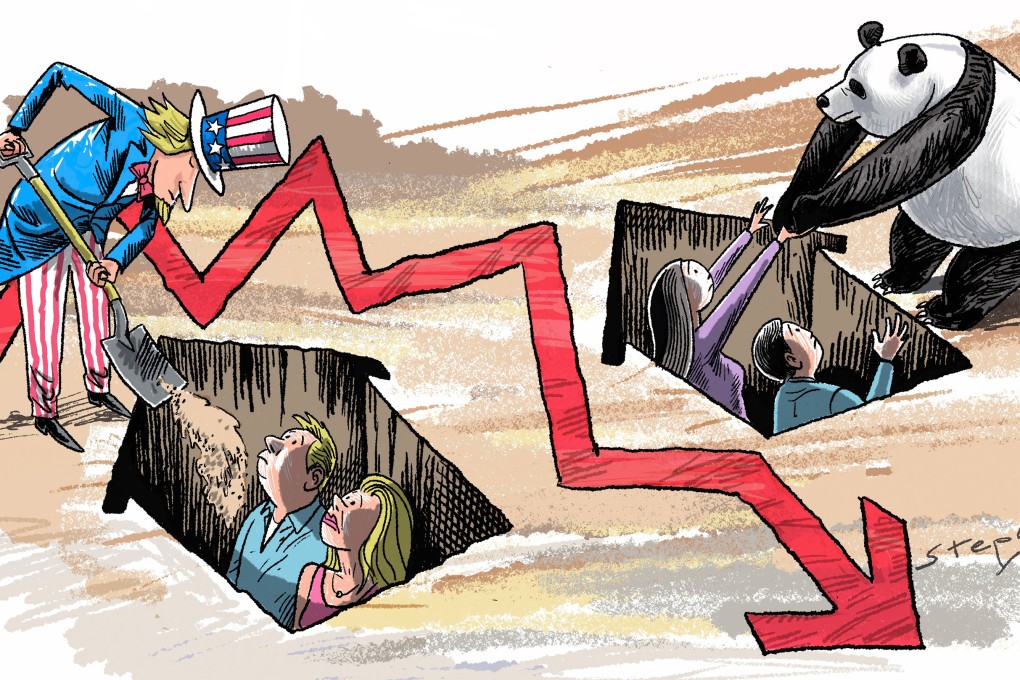

- Any rescue plan for a crashing property sector must be fair by supporting prudent homeowners and penalising errant banks and companies

- Bailing out the big banks while leaving ordinary citizens to suffer the pain of foreclosure, as the US did, will only fuel populist anger

Economic downturns have commonalities across history and locations, as Harvard professors Carmen Reinhart and Kenneth Rogoff taught us in This Time is Different. The book showed that banking and economic crises are often associated with falling equity markets and house price declines.

Once house prices begin to fall, economic woes deepen. When home prices are rising, owners feel much richer, and so they spend more as the good times roll.

But when the business cycle turns, and if home prices fall, consumers see their net worth shrink dramatically. In response, homeowners stop spending – a sensible and logical thing to do. But when many consumers all do the same, the economy falters, and a downward spiral can commence.

Such large declines would be bad news for the expectations of homeowners and consumers. A negative feedback loop of house price falls, consumer pullbacks and economic effects could begin, and may already be visible.