Advertisement

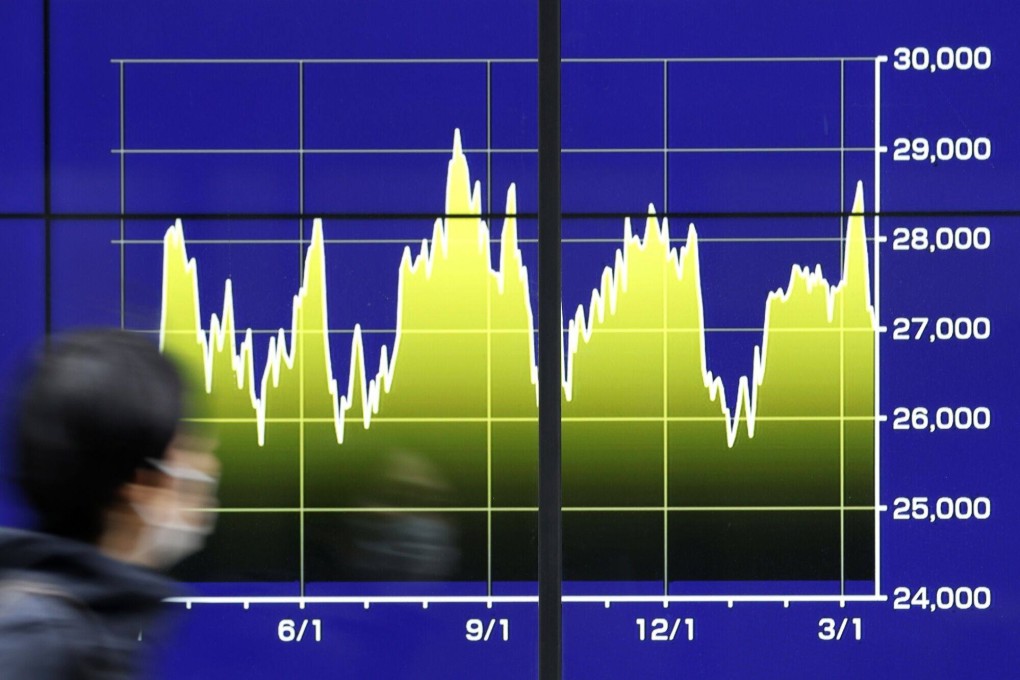

Opinion | It’s getting harder to be a savvy investor as financial and geopolitical risks grow

- Financial contagion fears, a toxic geopolitical environment and a proliferation of sanctions have made investors nervous

- When risks are rising and returns are falling, investors can only step with great care

Reading Time:3 minutes

Why you can trust SCMP

1

In these times of huge turmoil, where should I put my money? The collapse of Silicon Valley Bank (SVB) and UBS takeover of Credit Suisse have shaken investor confidence, despite swift action by the US and Swiss regulators to stop the contagion and contain the fallout.

The damage is done. Confidence in global financial regulation and bank management has been shaken, not just by continuing weaknesses in financial institutions after the 2008 Lehman Brothers collapse but also in the regulatory governance since.

In 2017, Mark Carney, as Bank of England governor and chairman of the Financial Stability Board, proclaimed that “the fault lines of the crisis have been repaired. The financial system is now better supervised and regulated. We have built a safer, simpler and fairer system”.

Advertisement

Such claims are shaky at best. SVB and Credit Suisse showed the fault lines had grown wider and, as London School of Economics professors Charles Goodhart and Jon Danielsson put it, “regulatory policy after 2008 is a failure”.

Bank runs are symptoms of massive investor insecurity. Both SVB and Credit Suisse showed that only a central bank’s provision of massive liquidity could stop the contagion.

Advertisement

Yet with SVB’s collapse, the US authorities protected all deposits – but not the bank’s shareholders or bondholders. With Credit Suisse, holders of the additional tier 1 bonds were left with nothing after the Swiss authorities wrote down the debt to zero. But the real reason for investor nervousness is the toxic geopolitical environment.

Advertisement

Select Voice

Select Speed

1.00x