Advertisement

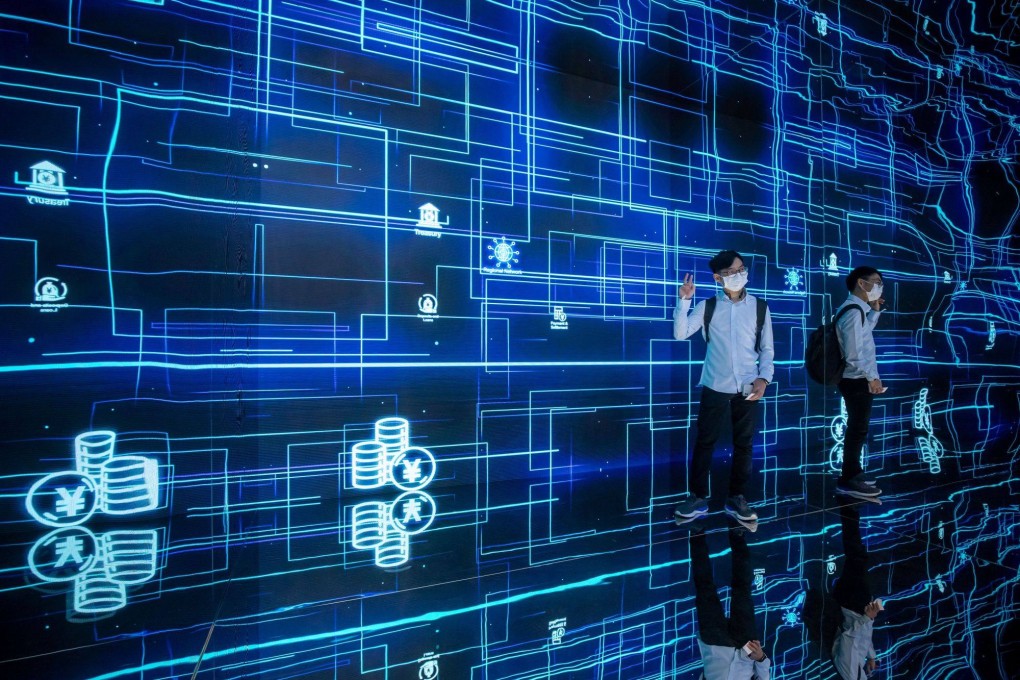

The View | For Hong Kong to become the world’s Web3 hub, regulation is not enough

- To manage risks, its regulatory framework needs to be nimbler. And to encourage innovation, it needs to be a leader in the tech infrastructure for digital assets

Reading Time:3 minutes

Why you can trust SCMP

The Hong Kong Monetary Authority recently published a paper on the regulation of stablecoin-related activity. This was in line with Hong Kong’s strategy to bridge next-generation digital assets with its well-established traditional finance ecosystem, the city’s key advantage in becoming a Web3 hub.

Regulations on stablecoin come as no surprise, given Hong Kong’s steady progress towards a clear and comprehensive framework.

But being a global financial centre with sophisticated regulation is not enough to give Hong Kong a sustainable edge over other potential hubs such as Silicon Valley, Dubai and Singapore. Hong Kong also needs to become a leader in the digital infrastructure that supports the creation and transaction of digital assets, and which attracts the best builders in the industry.

Advertisement

Hong Kong was once home to many influential cryptocurrency exchanges and still has more bitcoin ATMs than any other Asian city. But from 2019, because of the pandemic and cautious policies, Hong Kong’s role in the global cryptocurrency industry diminished.

But missing the cryptocurrency industry’s frantic boom and bust might not have been so bad. FTX, which was founded in Hong Kong but later moved to the Bahamas, turned out to be a multibillion-dollar financial disaster that dragged down the whole cryptocurrency industry. The cryptocurrency mining companies that chose to list on Nasdaq over the Hong Kong stock exchange are mostly in financial trouble now and under heavy criticism for their negative environmental impact.

Advertisement

The industry has entered reset mode, which gives Hong Kong a great opportunity to redefine what a Web3 hub should do.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x