Opinion | Xi’s plan for China’s economy leaves private firms facing an uncertain future

- After enjoying astonishing growth over the past decade, China’s private sector has recently gone into reverse, keeping global investors away

- Whether this is a short-term blip following the government’s regulatory crackdown, or something more intrinsic, remains to be seen

On the other hand, the private sector has made striking inroads into the Chinese economy over the past decade, thanks to Chinese entrepreneurs’ and workers’ impressive dynamism. We may now be at a turning point, when the former dynamic becomes dominant. But it’s still too early to be sure.

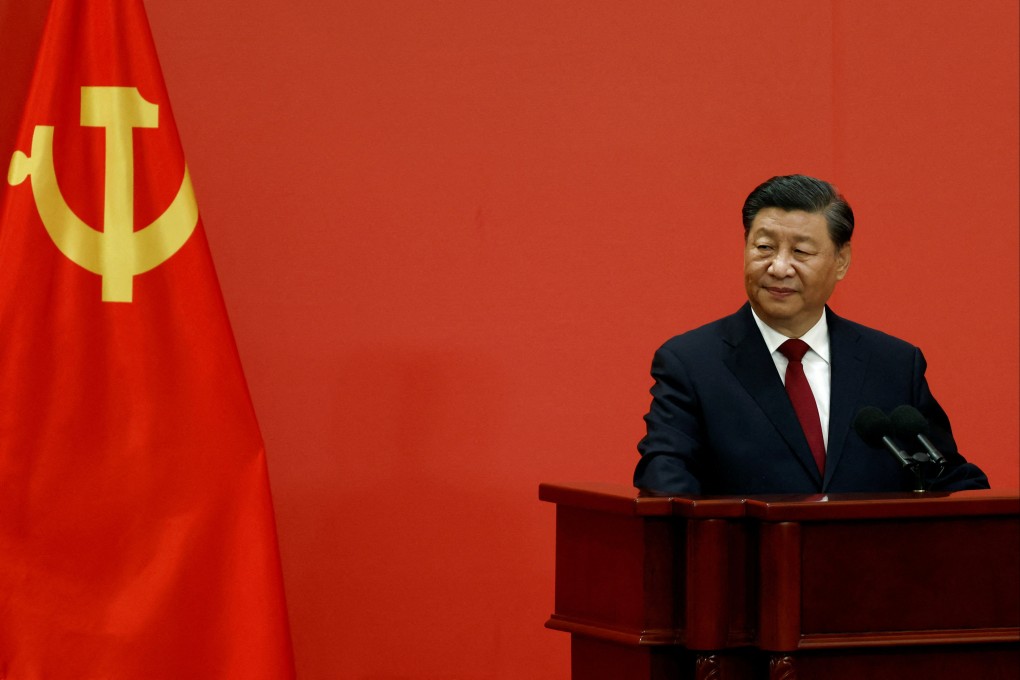

To have a clearer view of structural trends in the Chinese corporate landscape, we conducted an in-depth analysis of mainland China’s largest companies since Xi was chosen as China’s leader in late 2010.

What we found was a near-continuous increase in private-sector shares of, first, the revenue of China’s largest companies that made the Fortune Global 500 rankings and, second, the market value of the 100 most valuable Chinese listed companies, up until the end of 2020.