Macroscope | Fears that China has become ‘uninvestible’ are overblown – it is not Russia

- While pandemic woes and rising commodity prices have shaken investor confidence in China, it remains an open, globally accessible and growing market

- The real unease stems from Beijing’s regulatory uncertainty, but policymakers have caught onto this and promised relief

“Is China still investible?” has, therefore, become a serious question to ponder. Answering it may require examining three key dimensions.

The first is the economic dimension: has the macro environment, within which companies operate and assets are created, changed sufficiently to challenge one’s investment thesis? Such a change might be a drastic deterioration in the country’s long-run growth potential, which could impact the future stream of income generated by assets.

Or it could be a substantial increase in economic uncertainty that clouds the outlook of corporate earnings (relevant for equity), business survival (important for credits) and income generation of assets (like real estate).

An obvious example of a market that has become uninvestible recently is Russia, whose economy has been brought to its knees by Western sanctions and international isolation of its products. To the extent that these will have a lasting, but highly uncertain, consequence on Russia’s long-run economic growth, many investors may want to steer clear of Russia’s assets until the dust settles.

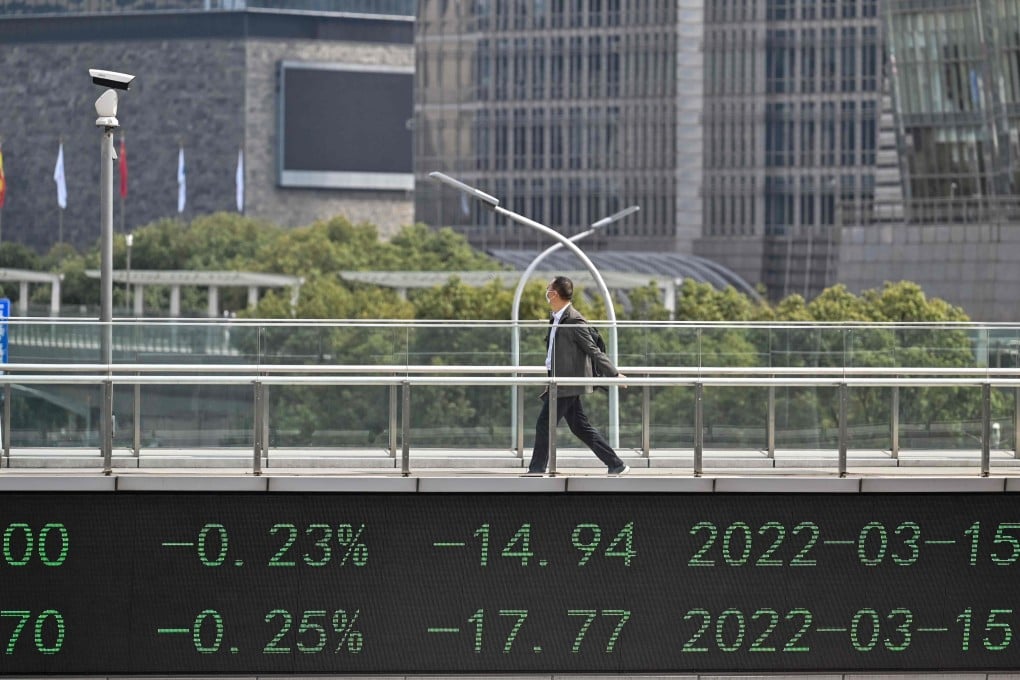

The Chinese economy is currently in a difficult spot, plagued by the pandemic, property market woes and high energy prices. However, it is questionable how long-lasting these forces will be, and to what extent they will inflict damages on China’s long-term growth outlook.