Opinion | How to ensure small businesses get the funding needed for green development

- Sustainable development funds are not reaching the small and medium-sized enterprises that need them most and are crucial for building a low-carbon economy

- New digital platforms can help match green start-ups with suitable investors, but traditional markets must also lower barriers that keep SMEs out

Last year was a banner year for sustainable finance, with the creation of the Glasgow Financial Alliance for Net Zero (GFANZ), managing over US$130 trillion in assets, sustainability bond issuance up to US$1 trillion, and record inflows of more than US$120 billion to environmental, social and governance targeted funds.

Indeed, there seems no shortage of cash for ESG. Does this mean the global transition to a low-carbon economy is on track? Yes and no.

For sure, mobilising finance to reward ESG-compliant companies is absolutely necessary. However, simply classifying financial assets as ESG does not deliver better outcomes if those funds cannot land where they are most needed. For this to change, built-in imbalances in global finance need to be overcome.

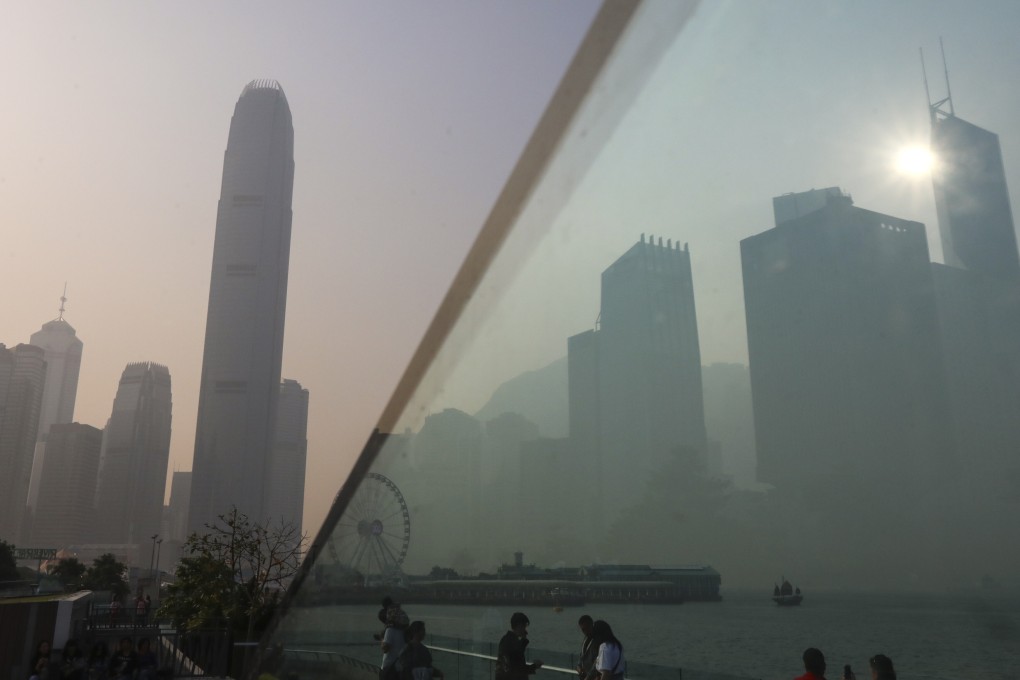

The first imbalance is between emerging and developed markets. Over half of global investment in net-zero initiatives should be channelled into the developing world. Asia alone requires US$3 trillion annually up to 2030 to achieve the UN Sustainable Development Goals (SDGs).

And yet, critically, most of the ESG-tagged assets are in Europe, while only 10 per cent are in Asia.

The second imbalance is between large and small companies or projects. The shortage of funds for micro, small and medium-sized enterprises (MSMEs) is a clear market failure. MSMEs create over 80 per cent of all jobs in developed or emerging markets, and contribute significantly to growth, social stability and innovation. Yet they are persistently finance-starved, even when the world is awash with liquidity.