Advertisement

Macroscope | Why the euro has more to fear from the yuan’s rise than the US dollar

- Crumbling political unity, policy stagnation and widespread failures in vaccination programmes have damaged markets’ confidence in the euro

- Meanwhile, the Fed’s reputation is intact, interest rates and yields remain supportive and US recovery plans should have positive spin-offs for global growth

Reading Time:3 minutes

Why you can trust SCMP

6

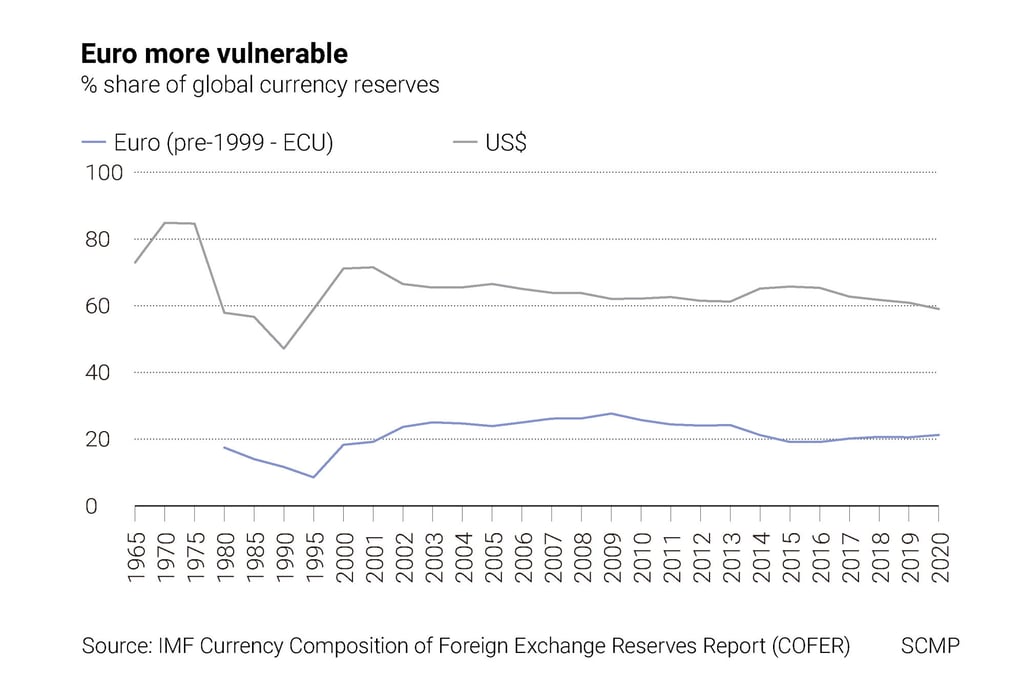

China has made good progress in encouraging the renminbi’s use as a fully fledged global reserve currency, but there is still a long way to go. At the moment, the renminbi’s share of world reserve holdings stands at 2.25 per cent, compared with 59 per cent for the US dollar and 21 per cent for the euro, according to the International Monetary Fund’s Currency Composition of Official Foreign Exchange Reserves report.

As global acceptance of the renminbi as a reserve currency spreads, which major currency stands to lose out? Conventional wisdom suggests it could be the US dollar as the renminbi’s popularity rises and investors fret about the greenback’s potential debasement after the United States’ policy stimulus responses following the 2008 crash and the Covid-19 pandemic.

However, the euro’s global status is more at risk from the renminbi’s rise. The dollar’s domination of global currency markets still seems impregnable, for the time being at least.

Advertisement

The dollar has a long-standing reputation, which the euro still lacks. The euro came into being in 1999 on a fanfare of optimism that it would eventually challenge the dollar’s domination of global currency markets. After a strong start, the euro’s standing was badly scarred by the 2010-2012 European debt crisis.

The euro’s survival was on the line and only saved by a financial lifeline thrown by the European Central Bank and the European Union. Investor confidence has never fully recovered, with the euro’s share of the global currency reserves retreating from a peak of almost 28 per cent in 2009 to around 20 per cent in recent years.

Recent events have hardly helped matters, leaving the euro more vulnerable than the dollar. The failure to implement Covid-19 vaccination programmes more effectively has been a political own-goal for the EU.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x