Advertisement

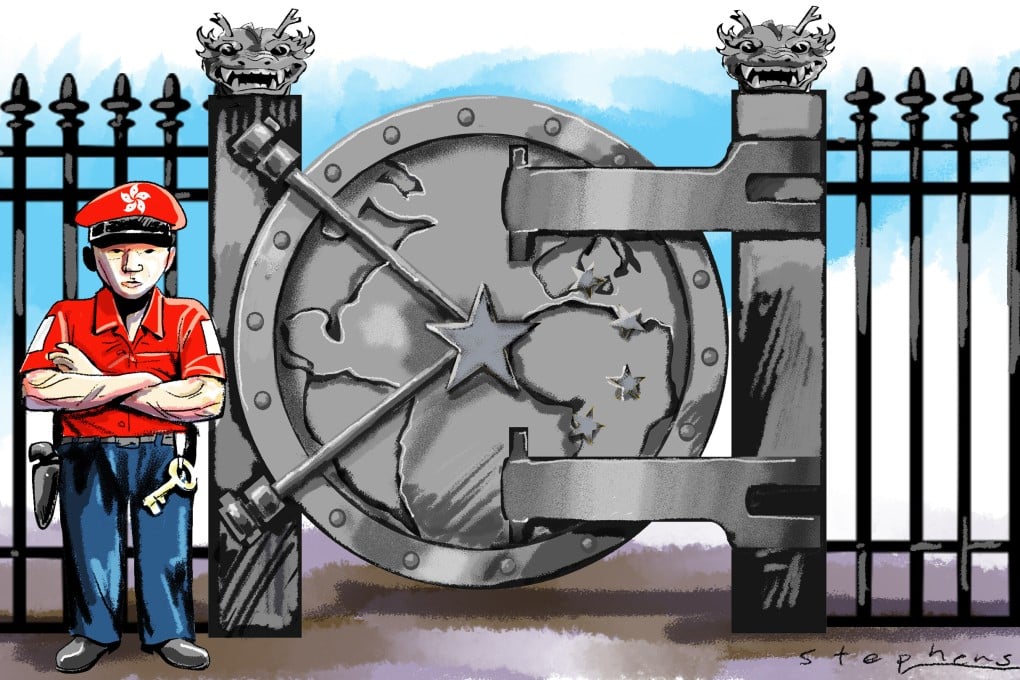

Opinion | As China’s gateway to global capital, Hong Kong has a key role in safeguarding financial stability and national security

- By regulating for safe, stable market operations, and addressing cross-border capital flow risks, Hong Kong can safeguard China’s economic and financial security

Reading Time:3 minutes

Why you can trust SCMP

1

Financial security is an integral component of national security, providing an important foundation for the steady and healthy development of China’s economy. The prevention and control of financial risks, including enhancing the framework for managing cross-border capital flows, strengthening regulatory cooperation as well as upgrading risk prevention and control capabilities, is key as China continues to deepen its financial reforms and accelerate its connectivity and integration with global capital markets.

As China’s key international financial centre and offshore market, Hong Kong has a pivotal role in ensuring the stability and orderliness of its own financial markets to help safeguard financial stability and national security.

It is essential that Hong Kong leverages both its close ties with global markets and its safe and well-regulated offshore environment and continues to capitalise on its own strengths and support the steady opening up of China’s financial industry. In doing so, Hong Kong must effectively prevent or address any risks emanating from cross-border capital flows and enhance financial regulation to safeguard China’s economic and financial security.

Advertisement

Hong Kong can also play a key role in the management of cross-border risks. Over the years, the smooth running of mutual market access schemes between the mainland and Hong Kong proves that the city can serve as a buffer zone in supporting the mainland to withstand global market volatility and deal with considerable capital flows under extreme conditions.

Hong Kong also has an internationally recognised regulatory framework and a robust and dynamic financial system which has demonstrated high resilience in the face of adversity through the past global financial crises.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x