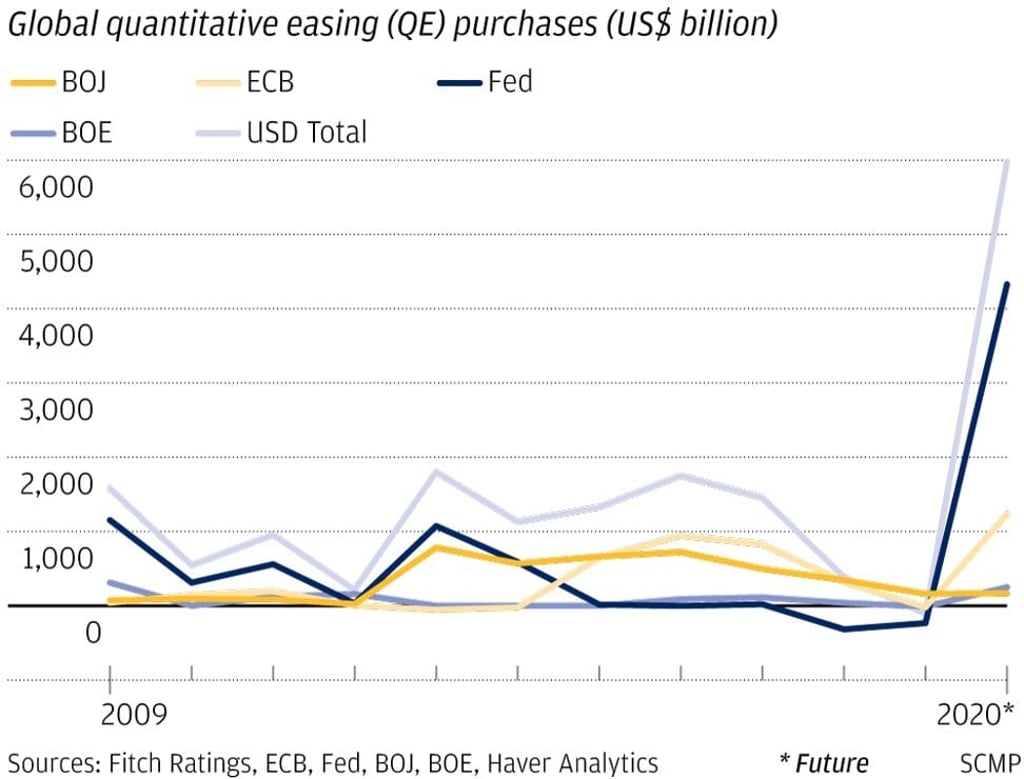

The world’s free-spending, money-printing spree will cost us dearly in the end

- The world has mortgaged its economic and monetary future to uncertainty in the hope that the global economy will come roaring back after the pandemic

- In reality, the cost of these well-intended but ultimately irresponsible policy actions could be inflation, financial crisis and a deeper recession

Bravery can be difficult to distinguish from foolhardiness until the consequences prove the action to be coolly courageous or rash and recklessly bold. So, does unlimited fiscal and monetary stimulus signal an entry into a brave new world or a foolhardy plunge into disaster?

It seems we are intent on shedding all traditional economic and financial anchors at the same time and setting sail upon a sea of change and uncertainty with few or no navigational aids. To end up in anything other than a shipwreck would be little short of a miracle.

The world has mortgaged its economic and monetary future to uncertainty in the hope that the global economy will come roaring back after the pandemic. In reality, the cost of these well-intended but ultimately irresponsible policy actions could be inflation, financial crisis and a deeper recession.