Advertisement

How US-China tensions are pushing US-listed Chinese tech firms to Hong Kong

- Growing geopolitical rivalry, increasing US investor suspicion of Chinese firms and a more attractive HKEX following years of reforms are feeding a growing trend of ‘repatriation’

- Expect not just more secondary listings in Hong Kong, but also US delistings and Hong Kong relistings

Reading Time:4 minutes

Why you can trust SCMP

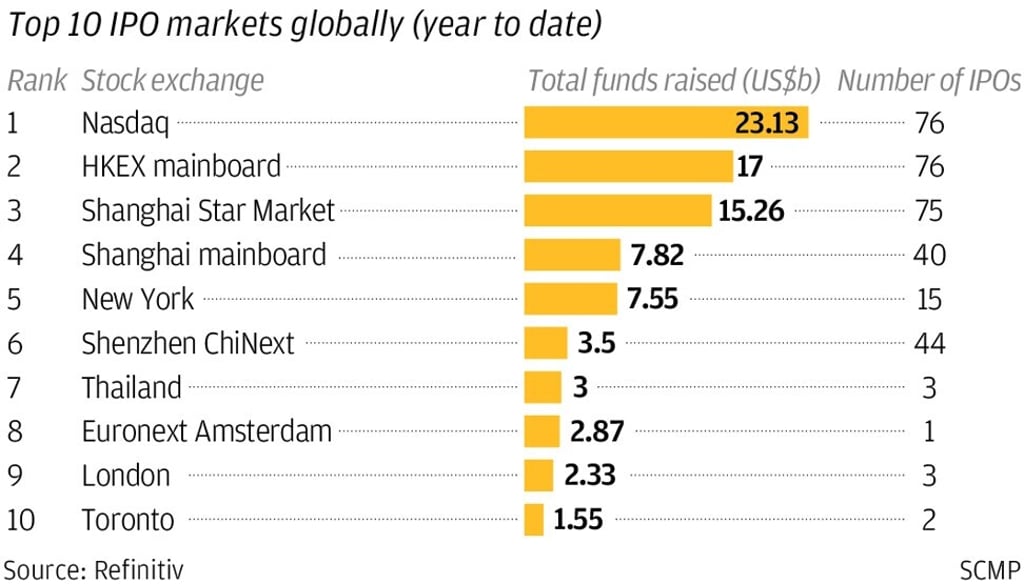

The recent filing by Ant Group, the financial affiliate of Alibaba, to list its shares in Hong Kong and on Shanghai’s Star Market, China’s Nasdaq-like tech board, comes after a study highlighted 31 US-listed Chinese companies that could flock to the Hong Kong bourse. This has been a long time coming, with the fallout from several US-listed Chinese companies, most notably those exposed by Muddy Waters early last decade.

Alibaba’s secondary listing in Hong Kong last year essentially set off a repatriation trend. [Alibaba, which owns 33 per cent of Ant, is the owner of the South China Morning Post]. In June, we saw two Chinese technology giants, NetEase and JD.com, choose Hong Kong for their secondary listings, raising some US$6.7 billion. In the short to medium term, more secondary listings – or US delistings and Hong Kong relistings – can be expected.

This is something that Hong Kong Exchanges and Clearing (HKEX) and the Hong Kong government are very keen to realise, after the recent market reforms with a strong emphasis on leading sectors such as technology, biotech and life sciences. We have also seen the introduction of weighted voting rights structures or dual-class shares, a critical determinant of the listing jurisdiction for these sectors.

Advertisement

In light of the US-China situation, expect more, if not accelerated, repatriation activities over the next one to two years. Many factors affect where companies choose to float their shares, and a key consideration, particularly for the initial public offering, is pricing/valuation, of which the interest of the general investing public is vital.

Advertisement

For the past few decades, the US market has dominated the listing of technology stocks, with its exceptionally diverse base of investors and investment managers, many of whom have a significant interest in this sector, resulting in higher multiples (measures of a company’s financial well-being) and greater liquidity.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x