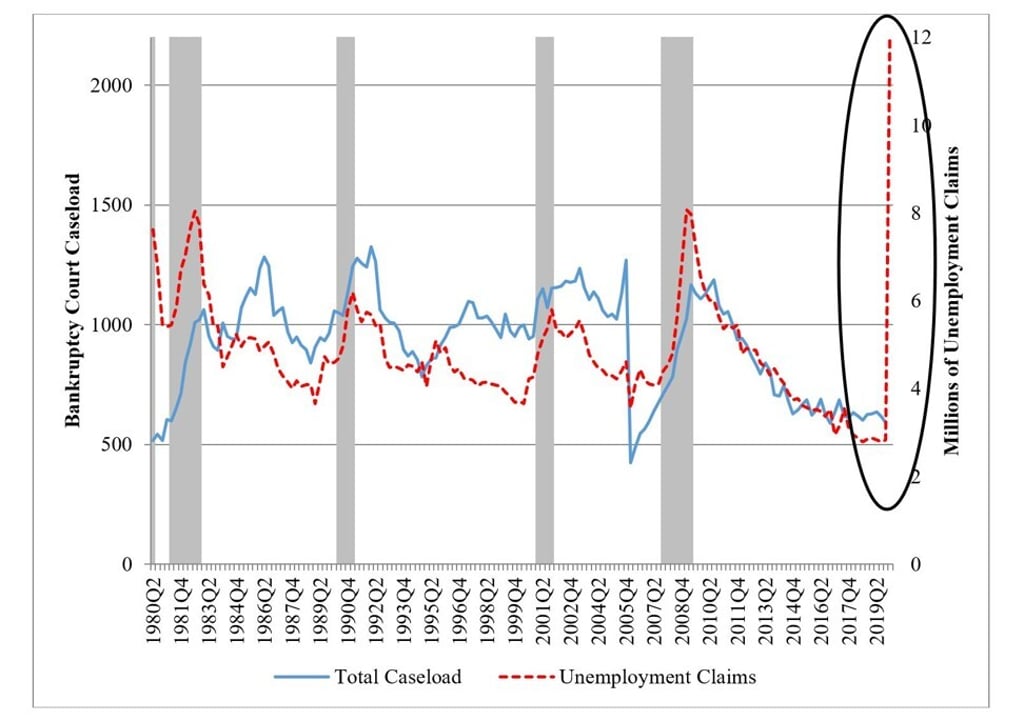

America is facing an unprecedented wave of bankruptcies. It must act now

- The US has a narrow window to prepare its courts and judges for an epidemic of bankruptcies and ensure the smooth passage of restructuring. Leaving the system to be overwhelmed would spell economic disaster

Neiman Marcus and JC Penney, two of America’s retailing giants, recently failed to pay interest on their debt. We should expect one or both firms to file for bankruptcy soon, heralding a surge of US business failures caused by the Covid-19 pandemic. And, with most American households lacking the cash to pay expenses for three months, many families and individuals will declare bankruptcy, too.

Before long, the US could face a trifecta of millions of insolvent consumers, thousands of small-business failures and many bankruptcies of large public firms, with whole industries going broke at the same time.

Bankruptcy works well enough and quickly enough in normal times, particularly in restructuring large public firms. But it cannot work well, and the economy will suffer, if the system is overloaded and businesses become stuck in legal proceedings.