Advertisement

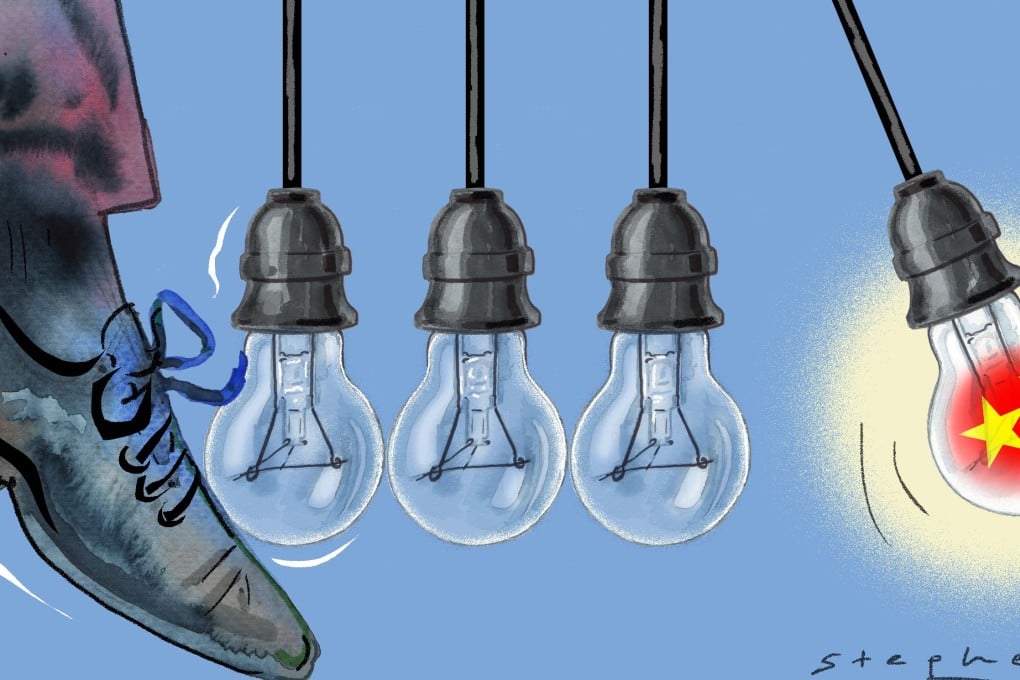

Opinion | How US trade war and other efforts to thwart China’s rise have actually accelerated its reform and innovation

- Edward Tse says the trade war has made a stronger case for China’s reform and innovation. However, foreign multinationals should also realise they can’t be complacent any more: they should learn to innovate in, and for, the Chinese market

Reading Time:4 minutes

Why you can trust SCMP

0

In trying to curb China’s supposedly unfair trade practices and substantially reduce its trade deficit with China, the United States is unintentionally helping to accelerate China’s reform and innovation.

Washington’s trade war has gained support from many in the Sinophobic circle of politicians, businesses and lobbyists, who have long complained about Beijing’s treatment of foreign businesses, especially those from the US, on issues such as intellectual property protection, forced technology transfer and market access.

However, while it is arguable that China’s market liberalisation could be faster, it is unfair to say Beijing has blocked most foreign companies. In the tech sector, pundits lament that Facebook and Twitter are blocked in China, but neglect to mention Apple, Amazon, Bing, LinkedIn, eBay and Airbnb are not.

While Chinese tech giant Huawei has met with the American and other governments’ roadblocks overseas, its American counterpart Cisco continues to do business in China. As The Economist’s Schumpeter column notes in the June 28 edition, the picture of American firms being victimised in China is exaggerated.

Since US President Donald Trump’ tariff war broke out, China has accelerated the opening of its market to foreign companies. Last April, Beijing set a timetable for phasing out foreign ownership limits in the automotive industry. It is also easing curbs on sectors such as banking, securities, insurance, agriculture and aircraft manufacturing. Recently, BT Group became the first non-Chinese telecom company in China to get a nationwide operating licence. S&P Global’s Beijing-based wholly-owned subsidiary was also given a green light to enter the Chinese bond rating market.

Advertisement