Advertisement

HKEX’s new listing rules will bring the tech economy to Hong Kong, not just the stock market

Paul Lau says the Hong Kong stock exchange’s overhaul of its listing regime to make the bourse more attractive to technology firms will not only expand capital markets in the region, but also spark innovation in the Greater Bay Area

Reading Time:3 minutes

Why you can trust SCMP

With technology and innovative companies fast becoming key drivers of the global economy, the stock exchanges in mainland China and Hong Kong are taking steps to attract listings of these “new economy” companies to capitalise on this growing trend.

The conclusions drawn from the Hong Kong stock exchange’s recent consultation on a new listing regime for companies from emerging and innovative sectors mark the largest overhaul of its listing rules in decades. The new regime, which will come into effect on April 30, allows the listing of biotech companies that do not meet any of the financial eligibility tests of the main board, high-growth and innovative companies with weighted voting right structures, and issuers seeking a secondary listing in Hong Kong.

Advertisement

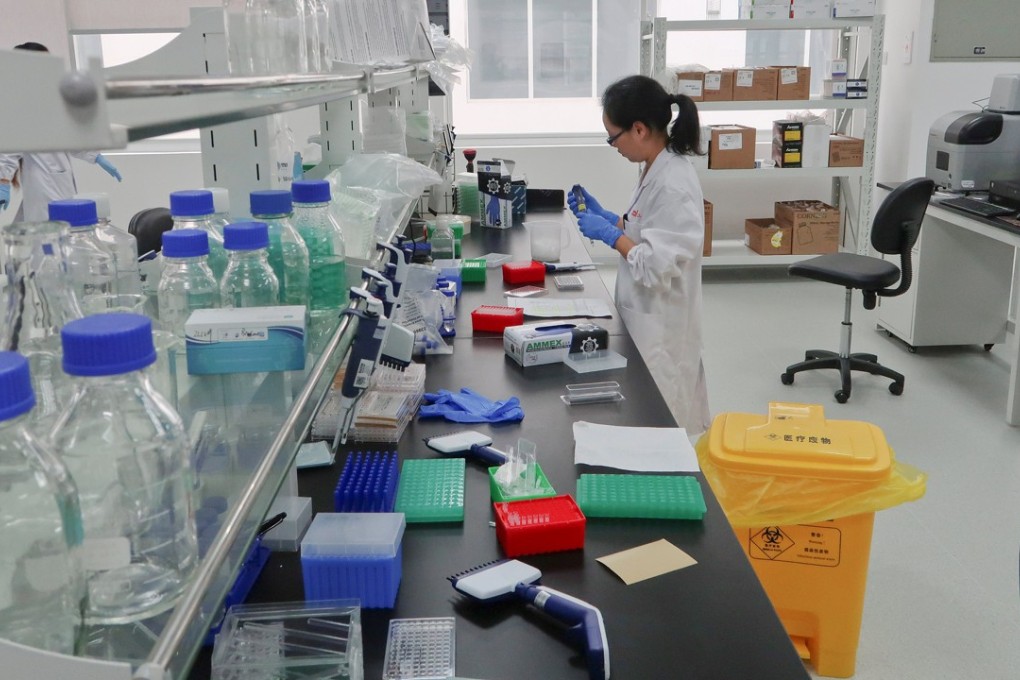

The new listing regime should enable Hong Kong to capitalise on opportunities from the up-and-coming biotech companies, which make up a majority of pre-revenue companies seeking a listing. The biotech sector being a traditionally highly regulated industry, the new rules also allow Hong Kong to adopt a cautious approach before expanding the regime to apply to pre-revenue companies in other sectors.

The pre-revenue nature of the biotech companies may bring additional risks if they fail to commercialise their products or sustain their business after listing

This measured approach is of particular significance as the pre-revenue nature of the biotech companies may bring additional risks if they fail to commercialise their products or sustain their business after listing. It is therefore very important for investors to be well-educated and informed of the risks involved, which is essential to maintaining an efficient and high-quality capital market.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x