Advertisement

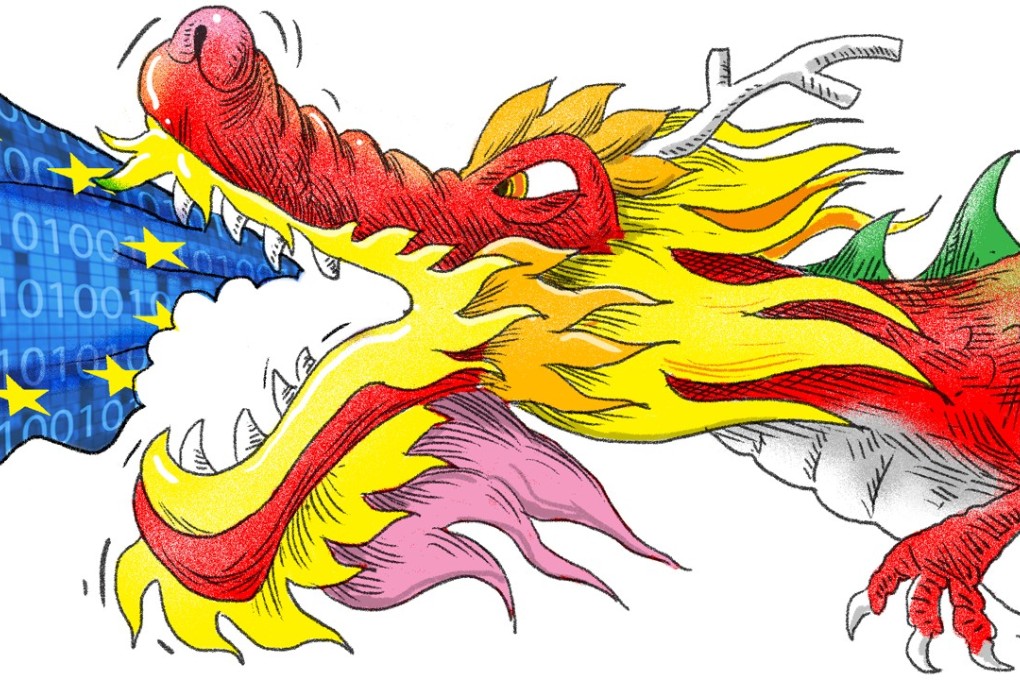

Europe’s security concerns over Chinese investments need to be addressed

Elisabeth Braw says Europe has largely welcomed the entry of China’s technology companies into its market, unlike the US, and questions about their intentions and how data is being used deserve to be heard

Reading Time:4 minutes

Why you can trust SCMP

0

Last month, a US government panel rejected Chinese internet tycoon Jack Ma’s US$1.2 billion bid for MoneyGram, a US-based money transfer firm. It was reported that, according to the Committee on Foreign Investment in the United States, the planned acquisition raised concerns that Ant Financial would use MoneyGram’s software to spy on US citizens. The companies mutually agreed to terminate the merger.

And in Congress, a bill that would bar Chinese telecoms giant Huawei from bidding for US government contracts is currently under consideration. The bill talks of national security concerns, citing a congressional investigation that found Huawei and several other companies to be “directly subject to direction by the Chinese Communist Party”. According to news reports, the US government is even considering nationalising the country’s planned 5G network over China-related security fears.

By contrast, Chinese companies already own plenty of sensitive companies in Europe. Denmark’s mobile phone network is, for example, operated by Huawei. The company provides mobile telephony infrastructure in Germany, Spain and the UK. Indeed, since encountering obstacles in the United States, Huawei seems to have turned its attention to Europe.

Watch: AT&T scraps deal to sell Huawei phones in the US

And plenty of other Chinese companies invest here too: in 2016, investments in the EU by companies based in China reached €35 billion (US$43.5 billion) – a whopping 77 per cent increase from 2015. In 2016, a Chinese company bought Greece’s Port of Piraeus, while a consortium led by China Railway Group won a contract to build a high-speed railway between Belgrade and Budapest.

But the mood is shifting in Europe, too. Several large countries, including Germany, which have in the past enthusiastically welcomed Chinese investments, are beginning to worry about the nature of those investments. That’s because an increasing share of Chinese business activity in Europe takes place in the technology sector. Huawei is the world’s largest telecoms infrastructure provider; it sells more mobile phones worldwide than any other company except Samsung. And, in 2016, Chinese firm Midea acquired the German robotics maker Kuka.

European decision-makers are worried about the consumer data collected by the Chinese companies, and what they do with it. They’re concerned about European know-how migrating to China as a result of the Chinese firms’ vast presence in Europe – even as European firms lack reciprocal access to the Chinese market.

Censorship, market access and forced tech transfer: the tricky business in Germany’s trade ties with China

China promises more market access for foreign players

Advertisement

Select Voice

Choose your listening speed

Get through articles 2-3x faster

1.1x

220 WPM

Slow

Normal

Fast

1.1x