Why Donald Trump’s economic plan is a non-starter

Feng Da Hsuan and Liang Haiming say when studied in detail, the US leader’s push to launch a major infrastructure plan, introduce big tax cuts, revitalise US manufacturing and adopt a protectionist stance will fall far short of actually helping the economy

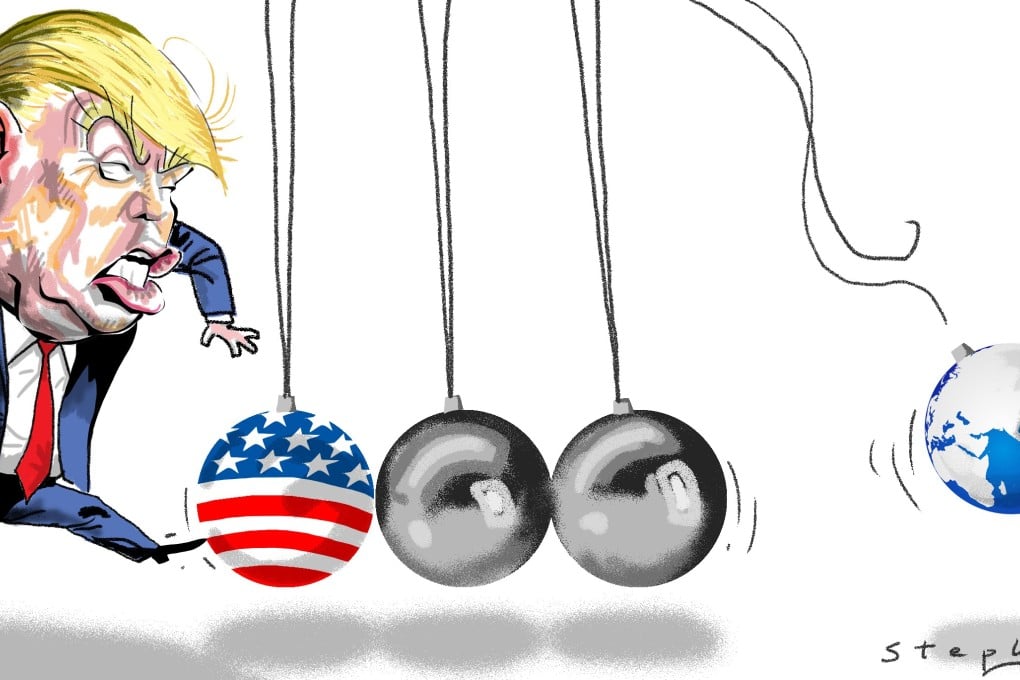

However, the market is more likely shaped by invisible hands, while Trump’s economics seems to be the intrusive hands which serve only to disturb it. Thus, the lingering question is whether his plan can truly revitalise the US economy. Indeed, it is difficult to be too optimistic about its sustainability.

First, while a proposal to massively increase the nation’s infrastructure is to be welcomed, as the old saying goes, “vision without execution is hallucination”. To prevent such hallucinations, Trump has proposed to throw in US$1 trillion to get the projects up and running. Yet, even if the US technological prowess, industrial foundations and population structure could do their part to spur growth, where exactly can this money be found in the current US financial landscape?

US debt currently stands at US$20 trillion, approximately 106 per cent of national gross domestic product. By 2027, it is expected to reach US$30 trillion. Amid such warning signs, to further burden the US national debt with the infrastructure plan appears ill-advised. With this in mind, we believe that the project will either be shrunk significantly or abandoned altogether. In either case, it may well cause the market bubble to collapse.

Fed wrestles with inflation and impact of Trump’s stimulus plans on US economy

Second, it is doubtful that a massive tax cut is as attractive as it might appear. Trump wants to cut commercial taxation from 35 per cent to 15 per cent, encouraging foreign corporations to invest in the United States. Unfortunately, even a 15 per cent rate is unlikely to be competitive, especially considering that many corporations prefer to register in overseas tax havens, such as the Cayman Islands, British Virgin Islands, Bermuda and the like. In addition, these tax havens have simple and loose corporate legal requirements regarding how dividends are distributed, in contrast with the stringent tax avoidance laws in the US. For any global corporation, the US is clearly not an attractive option.