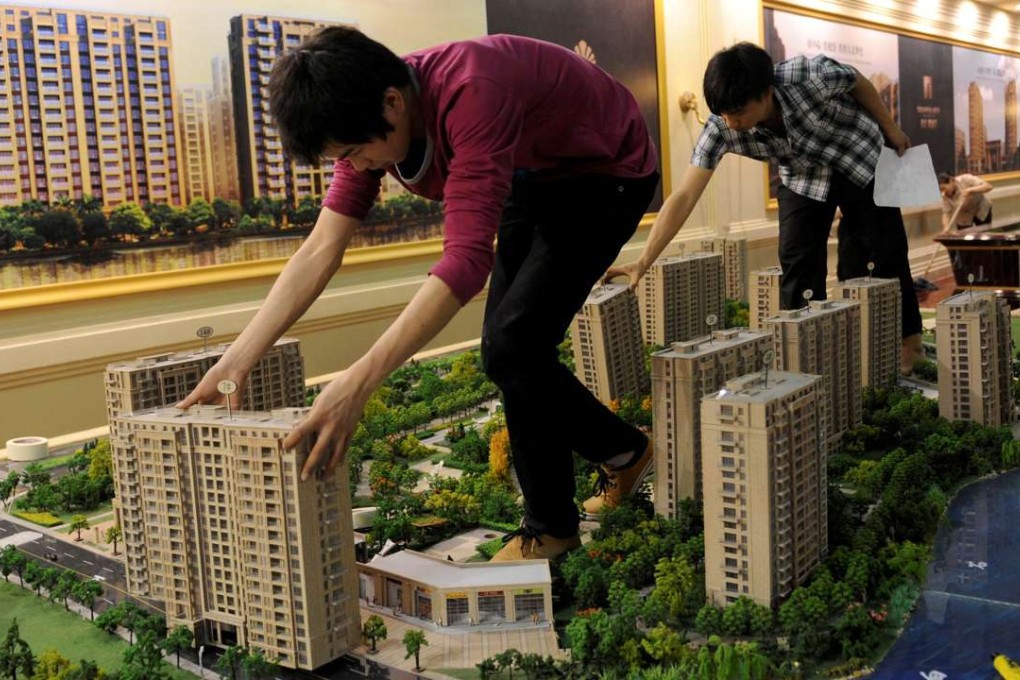

China’s property boom won’t be over any time soon

Thomas Deng says soaring prices are mainly confined to the major cities, while housing in the rest of the country remains affordable. People should ignore the dire warnings and get ready for prices to rise further

Property prices in China have roared to life this year. As of September 30, prices in 70 cities were up by an average of 9.3 per cent year on year, and those in tier-one cities have soared 31.9 per cent year on year.

Chinese property has become a colossal asset class, aggregating more than US$20 trillion in market value (as of 2014), based on government estimates. Meanwhile, residential property currently accounts for 60 per cent of total households’ balance sheets, among the highest worldwide; the optimal level, from a global perspective, is around 25 per cent.

So the question on everyone’s mind is not if, but when, this bubble will finally burst. The short answer: not any time soon.

Middle class fall prey to Beijing’s manipulation of the property market

China’s property market is a tale of two cities – specifically, higher-tier and lower-tier cities. Following the recent price rally, China’s tier-one cities have become increasingly unaffordable; the prices-to-household-disposable-income ratio in tier-one cities was 14.7 at the end of 2015; it’s now around 18-20. Housing affordability in China’s tier-one cities is comparable to Hong Kong’s. Absolute property prices, however, do not look excessively expensive relative to those in global cities like New York and London.

China property sector to stabilise as cooling measures take hold, Moody’s says

In lower-tier Chinese cities, affordability is less of a concern. The price-to-income ratio was 8 for tier-two cities at the end of last year and, even after this year’s surge, around 9 on average, excluding Xiamen (廈門) and Hangzhou ( 杭州 ). The ratio nationwide reached 7.2 at the end of 2015, the lowest in the past 17 years. So, as China’s tier-one and certain tier-two property markets boom, housing in the majority of the country remains affordable.