Ignore George Soros’ prophecy of doom; China has its economic situation well under control

Lau Nai-keung says the slowdown is just part of the restructuring process and while a few mistakes are inevitable along the way, it doesn’t mean China is heading for a hard landing

In an interview with Bloomberg TV in Davos at the World Economic Forum, George Soros declared that a hard landing of the Chinese economy was “almost unavoidable”, and that he has shorted US stocks and Asian currencies. This statement amounted to a formal declaration of war with China. The sharp fall in offshore renminbi and the Hong Kong dollar recently should be regarded as skirmishes.

Soros was aware that the deciding factor of his final battle lay in a general evaluation of China’s economic situation

The Chinese economy is now in a “new normal” status, with the growth rate slowing to below 7 per cent. This would be a relatively high rate in any other country, but it is a record low for China since its reform and opening up in 1978. Hence, it has created speculation overseas. Moreover, the yuan has devalued against the US dollar and there have been large fluctuations in China’s stock market, causing swings in stock and currency markets around the world.

Soros was aware that the deciding factor of his final battle lay in a general evaluation of China’s economic situation. To aid his financial attack, he has repeatedly let it be known that he is very pessimistic about the Chinese economy, to create a state of panic among the global investment community.

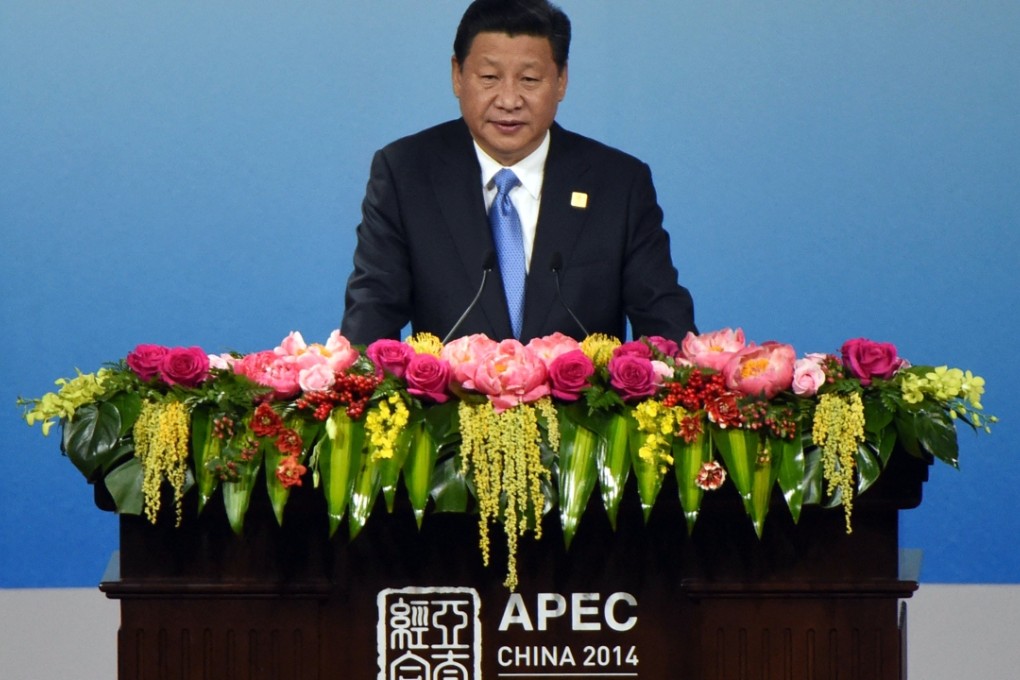

In his speech at the Asia-Pacific Economic Cooperation forum in November 2014, Xi went on to elaborate on the main characteristics of a new normal. In terms of speed: “from high-speed growth to medium-high speed”; structure: “continuous optimisation and upgrading of economic structure”; and, propulsion: “from factor driven and investment driven to innovation driven”.

It is clear that, 2½ years ago, the top decision-makers in China had already envisioned the economic slowdown that took place in the second half of last year, as an inevitable phenomenon of the new normal of economic transformation and upgrading. Just as a car travelling at high speed has to slow down for a sharp turn, so it is for the economy. If the driver isn’t careful, the car could be damaged.

READ MORE: Why sustained, healthy development will be the new normal for China’s economy

Of course, in that scenario, the problem lies with the driver, not the car. By the same token, there is no problem with the Chinese economy, but in the process of economic transformation, there are some problems with financial management, especially the management of general expectations about the economic growth rate, and the response when things slow down.