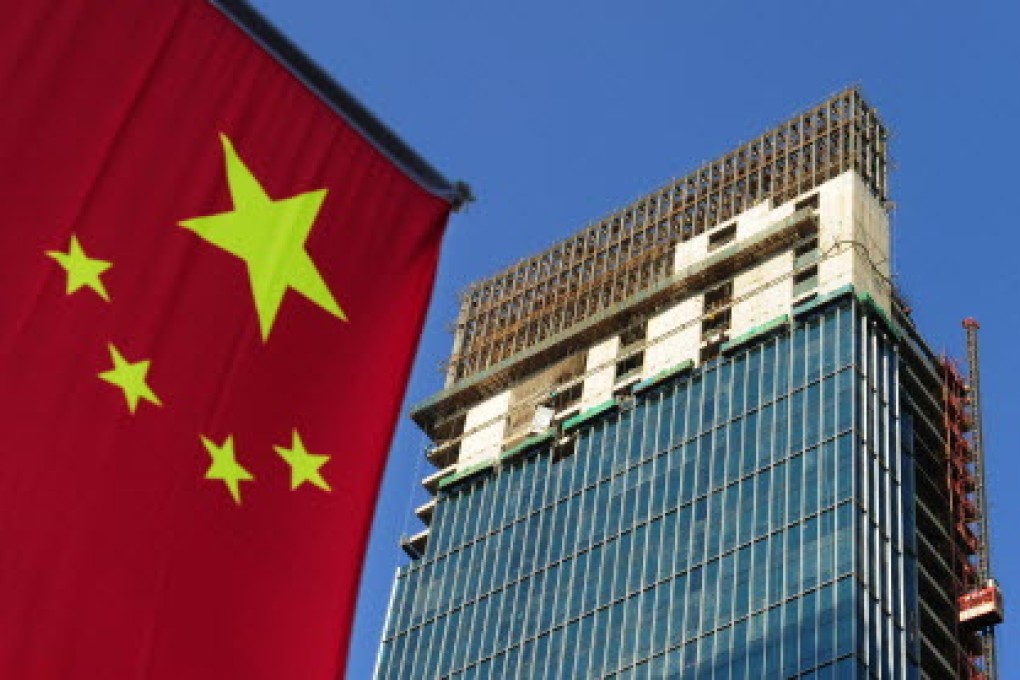

Beijing's grip on fiscal, financial control must loosen

Zhang Monan says decentralisation holds key to revitalising capital stock

Since the eruption of the global financial crisis in 2008, China has used massive economic stimulus to sustain growth. But unresolved structural problems have meant that the stimulus packages generated significant fiscal and financial risk, while doing little to improve China's capital stock.

Indeed, while China's capital stock is by no means small, capital structure and maturity mismatches have led to massive volumes of non-performing assets. So to reach the next stage of economic development, China must shift its focus from high gross domestic product growth towards revitalising its capital stock.

Premier Li Keqiang has said the government will not introduce any additional economic stimulus; instead, the authorities will pursue profound economic reform, even if that means slower GDP growth.

In addition, Li has called upon the banking sector to reinvigorate idle capital and allocate incremental capital more effectively. And the State Council recently published "Guidelines for the Structural Adjustment, Transformation, and Upgrading of the Financially Supported Economy", which outlines 10 key measures for revitalising the capital stock.

This implies major macroeconomic reforms. China is now attempting fiscal decentralisation to revitalise the public-finance position, while adopting financial decentralisation to maintain currency stability. Indeed, macroeconomic balance has become the government's main economic goal.

Over the last three decades, the gradual decentralisation of China's fiscal-management system enabled it to regulate transfers to sub-national governments, with the aim of clarifying revenue and expenditure at all levels. Why, then, did local-government balance sheets swing from surplus to deficit?

In 1994, a tax-distribution system was introduced that reduced the proportion of tax revenue held by local governments from 78 per cent in 1993 to 52 per cent in 2011, while raising the proportion of expenditure.