Mid-tier initial public offerings perform best in slow year for Hong Kong

It has not been a good year for the largest listings in Hong Kong. The top 10 initial public offerings fell an average 1.5 per cent on their first day of listing, and were showing a 6.5 per cent decline from their offer price at the end of September.

It has not been a good year for the largest listings in Hong Kong.

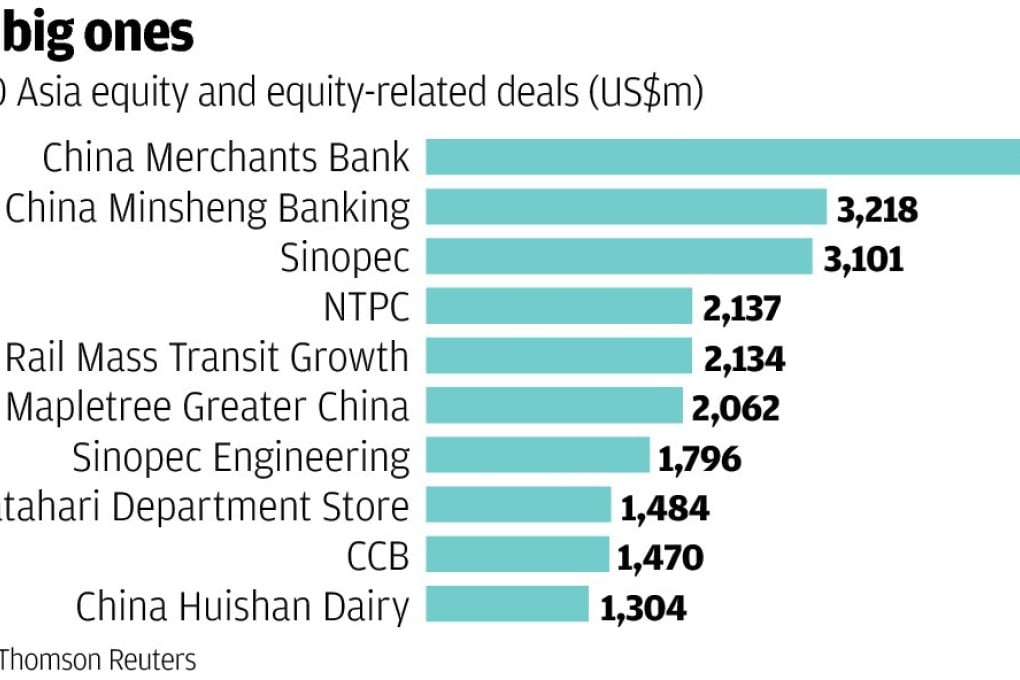

China Huishan Dairy dropped as much as 9.7 per cent on the first day of listing, on September 23, in a US$1.3 billion deal. As the second-largest public offering of the year so far, its performance has been much-watched in the way of guidance for the potential of listings in the fourth quarter.

Small-cap listings have not fared any better. Only two of the 10 smallest deals were in the black at the end of the third quarter - exactly the same for the largest listings.

Mid-tier companies have done best, according to Dealogic, with deals ranked between 11 and 20 in terms of market capitalisation posting a 17.2 per cent gain on their first day and sitting an average of 40.2 per cent higher than their offer prices at the end of September.

That figure is inflated somewhat by the performance of Beijing Tong Ren Tang Chinese Medicine, which had quadrupled by end-September after listing on the Growth Enterprise Market on April 30. But even excluding that, the shares of deals ranked 11 to 20 still gained 5.9 per cent in the first three quarters of the year.