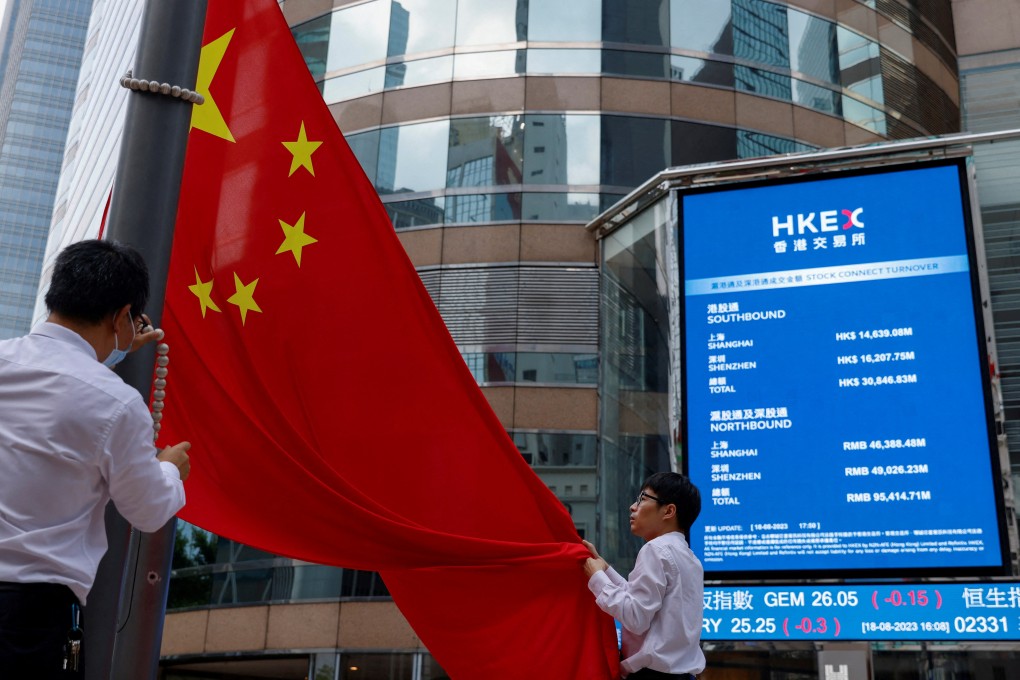

Hong Kong stocks rally after China’s top policymakers pledge more policy easing

China to adopt more proactive fiscal policies and “moderately loose” monetary policies to boost domestic demand, Politburo readout says

The Hang Seng Index jumped 2.8 per cent to 20,414.09 at the close, finishing above the 20,000-point mark for the first time since November 11. The single-day gain was the steepest since October 18. The Hang Seng Tech Index surged 4.3 per cent. China’s CSI 300 Index shed 0.2 per cent and the Shanghai Composite Index eased 0.1 per cent.

The monetary policy rhetoric was the same as what China’s central bank used in 2009 to mitigate the fallout from the global financial crisis, according to Zhang Zhiwei, an economist at Pinpoint Asset Management. That compared with the “prudent monetary policies” that top policymakers referred to at key meetings over the past few years.

“The message from Politburo meeting indicates a change in policy stance to help the economy,” said Zhang. “This shows the government recognises the urgency of the economic challenges China faces. Another positive signal … is the government plans to boost consumption significantly.”

The Politburo meeting readout came just days before an annual economic work conference, where Xi and other top policymakers are expected to convene this week to map out key economic policies for 2025. Fresh catalysts will be needed to sustain momentum for stocks in China and Hong Kong, where rebounds have shown signs of losing steam recently.