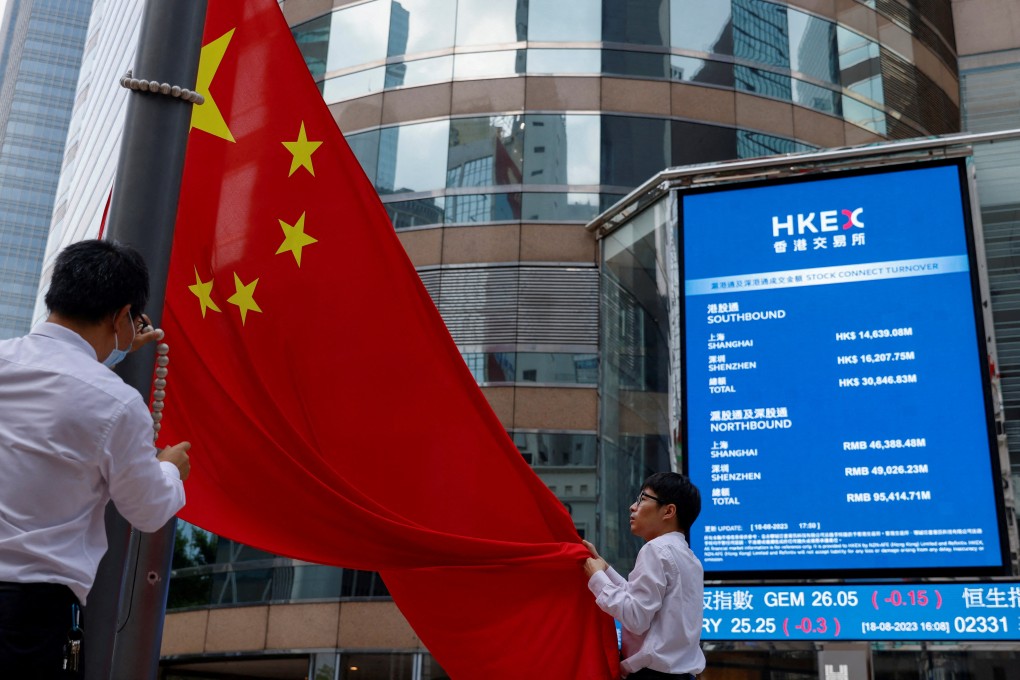

Hong Kong stocks’ 7-day slump worst since August, while Shanghai index hits May 2020 low on Taiwan tensions

- Strategists at Citigroup, HSBC trimmed their upside targets for the Hang Seng Index, citing concerns about interest rates and corporate earnings outlook

- China cranks up cross-strait tensions ahead of Taiwan’s presidential election on Saturday

The Hang Seng Index declined 0.6 per cent to 16,097.28 on Wednesday, adding to the 5 per cent slump in the preceding six days to post the longest losing streak since mid-August. The Tech Index slipped 0.8 per cent to a 13-month low, while the Shanghai Composite Index weakened 0.5 per cent to the lowest since May 2020.

Tencent fell 1.2 per cent to HK$280.20, Alibaba Group retreated 0.6 per cent to HK$69.30 and chip maker SMIC lost 2.2 per cent to HK$17.22. AIA Group tumbled 1.8 per cent to HK$62.45, while HSBC declined 0.9 per cent to HK$62.90. EV maker BYD fell 1.4 per cent to HK$204.60 and peer Li Auto dropped 4.4 per cent to HK$125.20.

“Stock performance appears to be increasingly detached from economic reality and earnings fundamentals,” Yan Wang, chief China strategist at Alpine Macro, said in a report on Tuesday. “The poor equity market reflects investors’ extremely weak confidence and Beijing’s badly damaged policy credibility, both of which are not easy to fix.”