Chinese water bottler Nongfu Spring soaks up more than a third of Hong Kong’s daily cash in a record-breaking stock sale

- The company, based in the Zhejiang provincial capital of Hangzhou, offered 388.2 million shares at HK$21.50 each in Hong Kong

- Nongfu’s retail shares were overbought by a record 1,147 times, locking up HK$677 billion (US$87 billion) in capital

Nongfu Spring, which makes 60 per cent in profit for every bottle of water it sells, has become the hottest initial public offering (IPO) in Hong Kong’s financial history, locking up so much money that it sent the cost of funds soaring in the city.

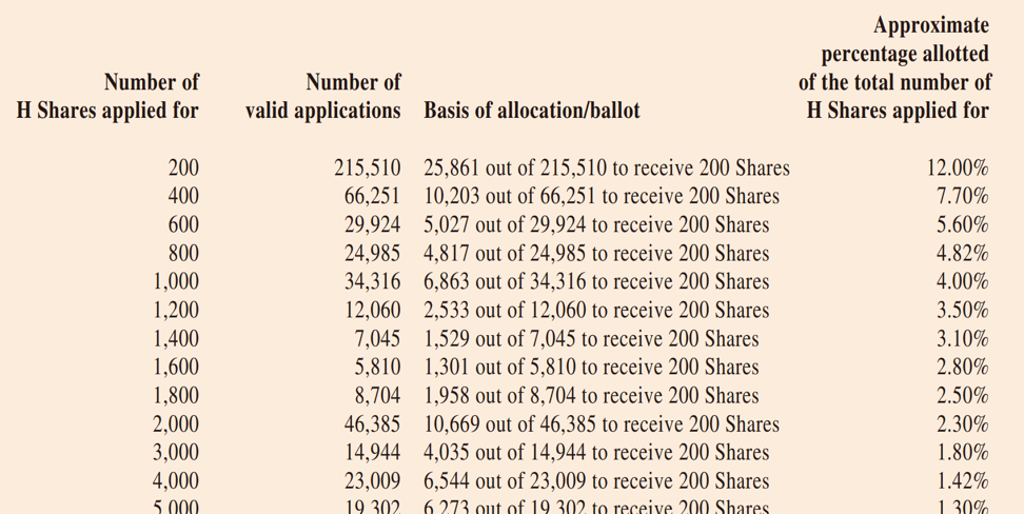

The company, based in the Zhejiang provincial capital of Hangzhou, offered 388.2 million shares at HK$21.50 each in Hong Kong, aiming to use its IPO proceeds of HK$8.35 billion to fund its growth. Instead, Nongfu’s retail shares were overbought by a record 1,147 times, locking up HK$677 billion (US$87 billion) in capital, according to a filing to the Hong Kong stock exchange.

“There’s plenty liquidity in the city right now, and the entire market’s focus is the IPO sector,” said Kenny Wen, wealth management strategist at brokerage Everbright Sun Hung Kai in Hong Kong. “Technology stocks in the secondary market have become very expensive, so investors have turned to look for opportunities in the new shares.”

Nongfu’s IPO broke the 2008 record set by China Railway Construction Corporation, when its HK$20.2 billion stock offer received HK$541 billion in bids. The bottler’s shares will debut on the Hong Kong stock exchange on September 8 , and the proceeds from unsuccessful bids will be returned to investors’ accounts.