Explainer | Covid-19 vaccine, treatment hunt sends Chinese biopharmaceuticals soaring. What investors need to know

- Share prices of Chinese biotechs targeting Covid-19 have soared

- Covid-19 is an especially virulent type of virus that makes coming up with a vaccine even harder

Chinese biopharmaceutical players have run ahead to be among the world’s most promising contenders in the race to treat and prevent Covid-19, earning them a close look by risk-tolerant investors despite run-ups in their share prices, analysts say.

Investors should divide the field between companies vying to create vaccines that stimulate the body to generate antibodies by injecting the body with a dead or weakened virus or part of a virus, and companies that manufacture “neutralising” antibodies and inject them into the body to directly tackle the virus.

Covid-19 is a so-called RNA virus, a type of virus that is highly mutable, adding to the usual difficulty of creating a vaccine. That is why Citi's head of China health care research Cui Cui says she favours companies on the hunt for effective antibody treatments over ones focused on vaccines.

“Vaccines may not be the best vehicle for investors in the Covid-19 sphere, because RNA viruses tend to have a higher mutation frequency, which makes it challenging to develop a vaccine that has long-term effectiveness,” Cui said. “Neutralising antibodies, on the other hand, could potentially be more effective.”

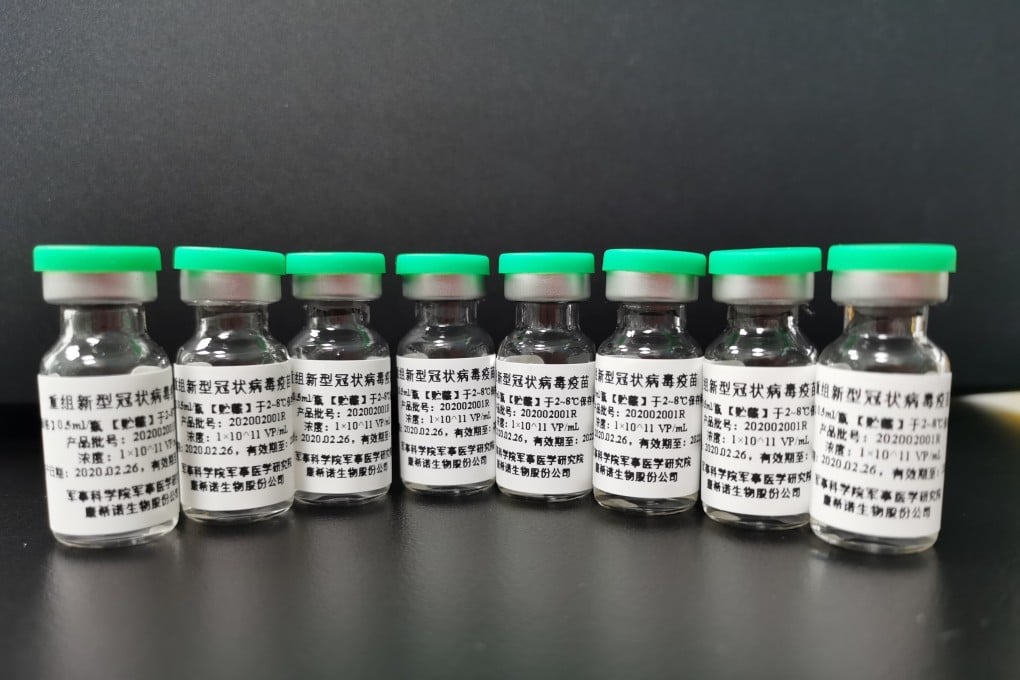

Chinese players in the “antibody” realm include Hong Kong and mainland-listed Shanghai Junshi Biosciences, Shanghai-based I-Mab Biopharma, which is listed in the US. Those focused on vaccine development include CanSino Biologics and Shanghai Fosun Pharmaceutical (Group), both of which are listed in Hong Kong, and WalVax Biotechnology and Chongqing Zhifei Biological Products, both of which are listed in Shenzhen and trade on the Stock Connect.