New | The best US election barometer: Gold

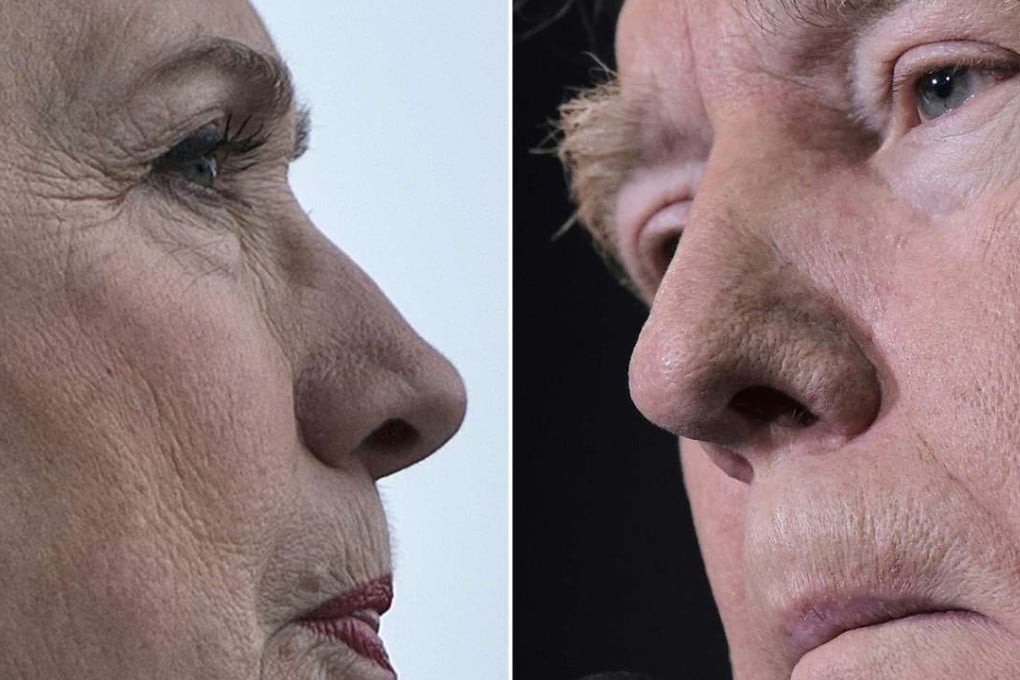

A Clinton win could see gold tumble; rally likely on Trump victory

Gold futures, which traded at $1,282.90 an ounce on Tuesday on the Comex in New York, could slip to US$1,250 within a week after a win by Democrat Hillary Clinton, based on the median of 23 estimates by analysts and traders surveyed by Bloomberg. A victory for Republican Donald Trump could see bullion rally to $1,395, a survey of 24 showed.

Bullion capped its longest rally since July last week as Trump, seen by some investors as the less predictable candidate, trimmed Clinton’s lead. The price surge came after FBI Director James Comey said the bureau was looking into more Clinton e-mails, spurring a flight to haven assets. The rally deflated Monday after Comey said his agency wouldn’t recommend criminal charges.

Election jitters have jumpstarted volatility in bullion, with a gauge of price swings over the past 15 days rebounding from a two-year low. The swings are likely to persist through the election, analysts said.

Here are some of the comments on gold’s outlook compiled through the survey and analyst notes:

A Trump victory represents “significant policy uncertainty,” Citigroup analysts including Edward Morse, Aakash Doshi and Nell Agate said in a November 3 report.

That could push gold to $1,400 in a “knee-jerk reaction,” the bank said. While a Clinton win could send prices down to $1,250 in the short term, her administration, coupled with a Democratic sweep in the House and the Senate, would allow for “sharp fiscal expansion, boosting US inflation prospects,” and help support bullion in the medium term, the analysts said.