Shares in WuXi Biologics Inc rose by 37 per cent in their trading debut in Hong Kong on Tuesday, making it the largest new listing so far this year.

The Chinese contract drug research and development company raised HK$3.98 billion (US$510 million) after pricing its initial public offering at the top end of the marketed range, with its IPO price set at HK$20.60 a share. The shares closed at HK$28.25.

WuXi Biologics’s debut has also come under the spotlight due to its stellar lineup of shareholders, which included high-profile firms such as Boyu Capital founded by Jiang Zemin’s grandson, and Yunfeng, an investment firm owned by Alibaba chairman Jack Ma Yun.

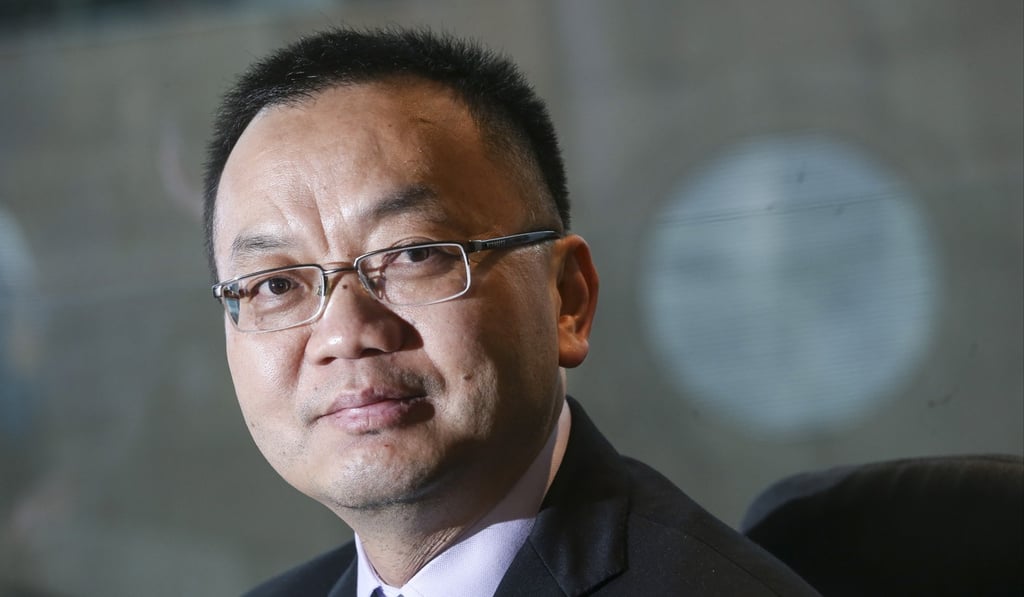

Chris Chen, chief executive officer of the Wuxi-based company, said the strong performance exceeded expectation.

He said he was pleased to see increased investor interests in the biologics industry, which produces drugs from genetically modified living organisms. Such medicines are used to treat a myriad of diseases including cancer and HIV.

“For example, a professor in Hong Kong University has a great idea for the next type of drugs. If someone can give him the money ..., we take that idea and make it into a drug,” he said.