Business disruption today can strike companies quickly, with a “big bang” when a product that is better and cheaper than anything else on the market suddenly becomes available.

But it can also creep up on you slowly. And when it hits, it hits hard. As a character in Ernest Hemingway’s novel The Sun Also Rises asks: “How did you go bankrupt?” “Two ways,” comes the answer. “Gradually, then suddenly.”

The first distinguishing feature of this gradual form of disruption is a prolonged decline in profit margins, even as revenue is increasing

This gradual-to-sudden decline is exactly the problem we identify in several industries today.

Our analysis of the performance of more than 1,200 companies in six of the most asset-heavy sectors – telecommunications, utilities, energy, materials, automotive, and industrials – revealed that incumbents in these industries are falling prey to what we call “compressive disruption”. And the first distinguishing feature of this gradual or “slow” form of disruption is a prolonged decline in profit margins, even as revenue is increasing.

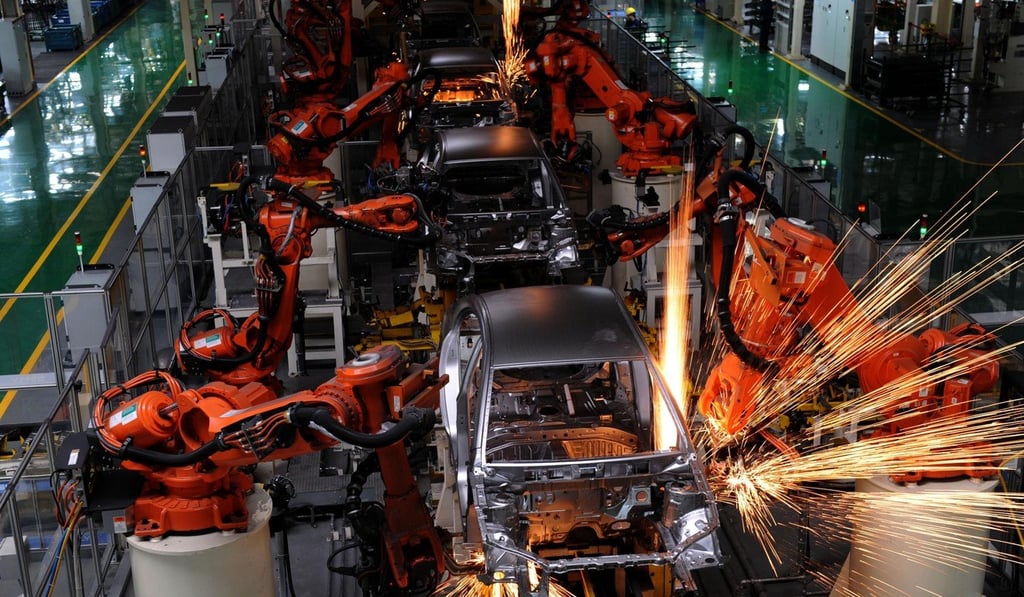

Consider the car industry. Between 2009 and 2013, global carmakers delivered an impressive 35 per cent growth rate, as revenues for the 49 largest manufacturers rose from US$1.34 trillion to US$1.81 trillion. However, industry profits during the same period remained roughly the same. Since then, growth in both revenues and profits have flat-lined. Stagnant revenue growth – in this case, a compound annual growth rate of about 1 per cent – is the second indicator of an industry headed toward potentially rapid decline.