The Insider | In a bullish sign, these five companies bought back their own shares in recent weeks

Mainland residential property developer Evergrande Real Estate Group along with other Hong Kong-listed companies bought back HK$3.7 billion worth of shares recently

Insider activity was basically flat this past week with 44 companies recording 197 transactions based on filings to the Hong Kong stock exchange.

However, the trading week of April 18 to 21, which was cut short by the Easter Monday holiday, saw transactions worth HK$555 million, up sharply from the previous week’s turnover of HK$325 million.

While the buying by directors was flat, buy-back activity surged with 23 companies recording trades worth HK$3.7 billion from April 13 to 20.

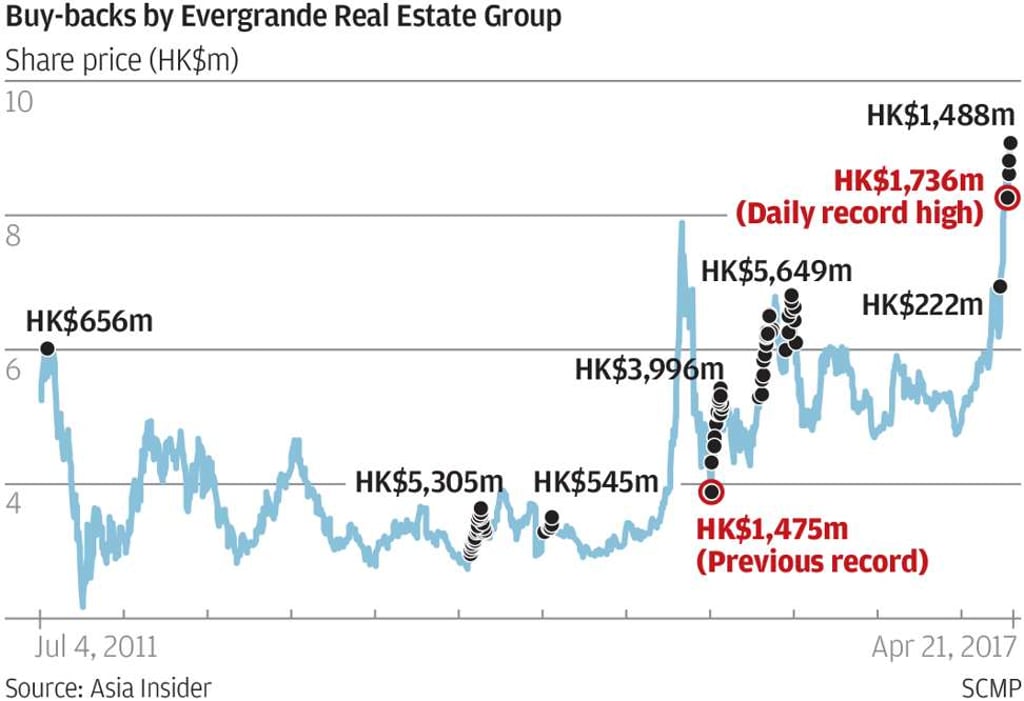

Most of the buy-back activity can be traced to mainland residential property developer Evergrande Real Estate Group, which repurchased 375 million shares worth HK$3.22 billion. The company started this recent buying spree with its largest transaction in terms of value since it started its buy-back programme in 2011, picking up nearly 203 million shares on April 13 worth HK$1.736 billion. The stock, incidentally, rose by more than 73 per cent from the company’s buy-back on July 15, 2015 through to the end of that year.

Future share price gains may be hard pressed as the recent repurchases were made on the back of a sharp rise in the share price since December 2016.

Another record was also broken last week with the group recording its highest buy-back price to date. The repurchases in the past month were made after the group announced in March that it would suffer a 51.3 per cent drop in profit attributable to shareholders to 5.09 billion yuan. The heavy buy-backs suggest that the group is investing its capital on its own shares as there are no better alternative investments on the horizon. This would not be surprising as the mainland government has introduced various measures to cool the surging property market. The stock closed at HK$9.03 on Friday.