China Gas hit hard by yuan depreciation, lower prices, asset writedowns

Currency exchange losses of HK$608.72 million contribute to 32.6 per cent fall in annual profits by leading supplier of gas to cities

Hong Kong-listed China Gas Holdings has reported a 32.6 per cent fall in annual net profits, which officials blamed on hefty losses arising from the yuan’s depreciation, lower gas prices, and the writedown of various assets and projects.

Net profit for the 12 months to March 31 amounted to HK$2.27 billion, down from HK$3.37 billion the previous year and compared to the HK$3.24 billion average estimate of 14 analysts polled by Thomson Reuters.

Revenue dropped 8 per cent to HK$29.14 billion, due to lower prices for the natural gas and liquefied petroleum gas it sells, officials said.

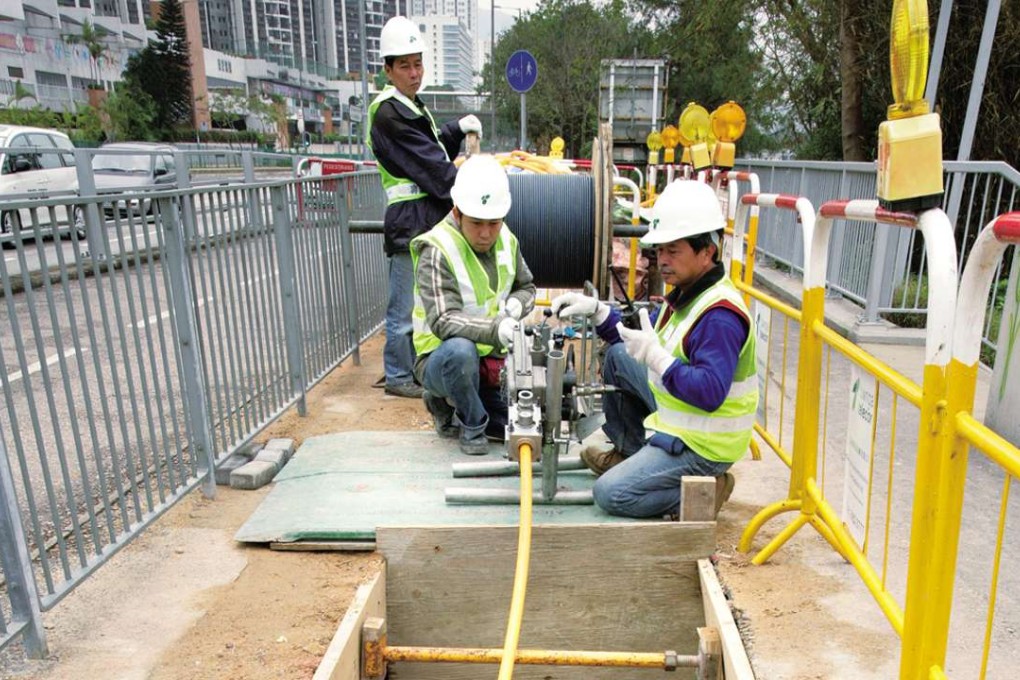

China Gas is involved in the distribution of city gas and natural gas, and the construction of long-distance natural-gas pipelines.

“The decrease in [net] profit was mainly due to the combined effect of one-off or non-operational factors [worth a total] HK$1.44 billion,” it said in a filing to Hong Kong’s stock exchange.

Excluding those factors, it said core net profit grew 11.9 per cent to HK$3.72 billion.