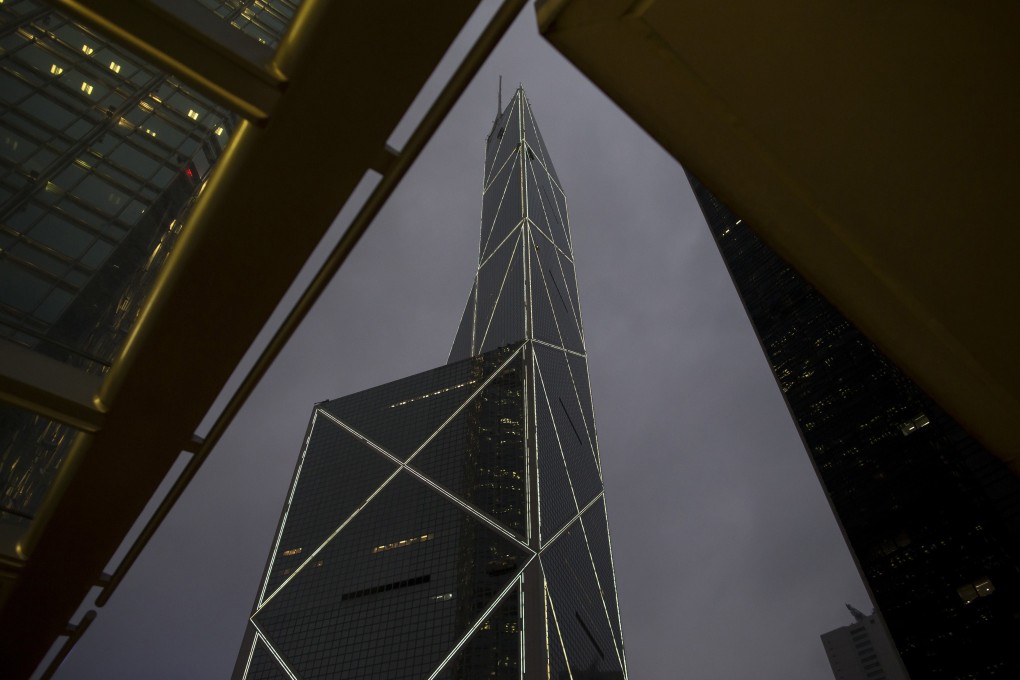

New | Bank of China (Hong Kong) weighs sale of Nanyang Commercial Bank

Nanyang Commercial Bank deal would help streamline the group's mainland operations

BOC Hong Kong (Holdings) is considering a sale of subsidiary Nanyang Commercial Bank that could fetch about US$6 billion, in a bid to stop cannibalising the business of its parent firm in China, sources said.

BOCHK is a unit of Bank of China, the country's fourth-biggest lender by assets, and a sale of Nanyang would help streamline the group's operations across the border, sources said.

As of June last year, half of Nanyang's loans were to Chinese customers, according to ratings agency Moody's.

An elimination of overlapping businesses could come as a boost for state-controlled Bank of China, which has seen a slowdown in profit growth and an increase in bad loans as the country's economic growth slows.

At US$6 billion, any sale would be the Asia-Pacific region's third-biggest bank deal, behind Australia's Westpac Banking Corp's US$17.9 billion purchase of St George Bank and Bank of America's US$7 billion purchase of a stake in China Construction Bank Corp, both in 2008.

One potential buyer interested in Nanyang was China Cinda Asset Management, China's second-biggest bad debt manager, which listed in Hong Kong in December 2013, sources said.