Belle warns of lower prospect for 2012 profit

Footwear firm's shares take a beating after it flags likelihood of just minor rise in results

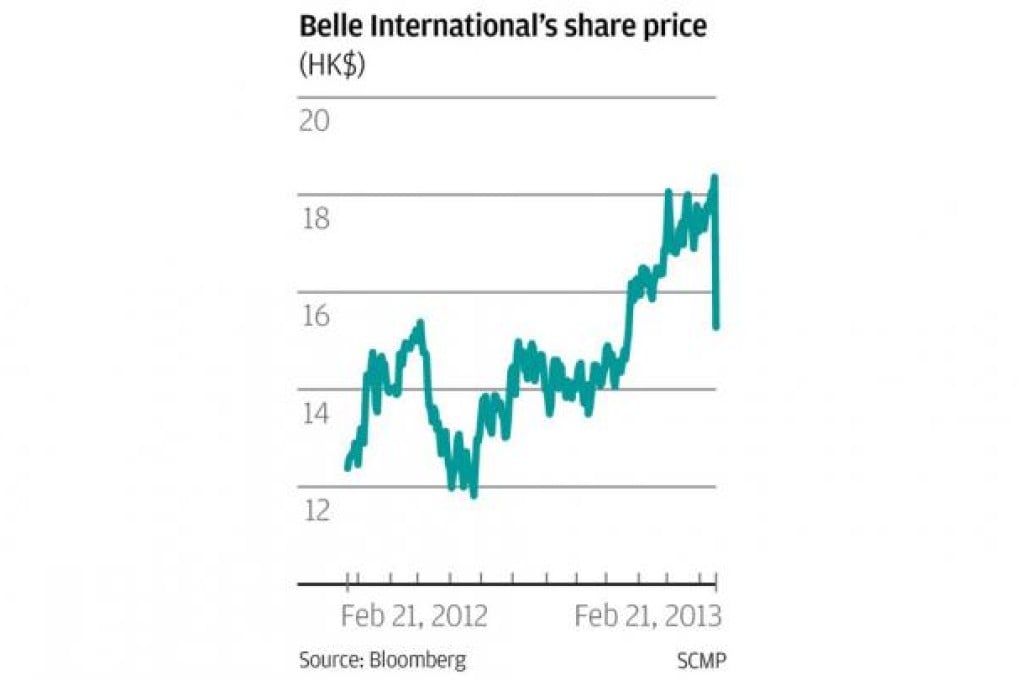

Shares of Belle International, the largest mainland footwear retailer, were hammered yesterday after the firm said it expected last year's profit to come in at the lower end of market estimates.

The stock price fell 18.2 per cent, the biggest intraday loss since the firm's listing in May 2007, before closing at HK$15.28, down 16.8 per cent. Its rival, Daphne International, dropped 6.4 per cent.

The company said in a filing on Wednesday that the net profit for the year "will be marginally higher" than that of the previous year and "fall within the lower end" of analysts' estimates.

Analysts had forecast that Belle would record a net profit of between 4.29 billion yuan (HK$5.33 billion) and 4.85 billion yuan, compared with 4.26 billion yuan a year earlier.

Spencer Leung, an analyst with UBS Investment Research, said: "The pre-announcement of the weak results came as a negative surprise to the market. We expect sales to further decelerate and negative same-store sales to emerge in 2013."