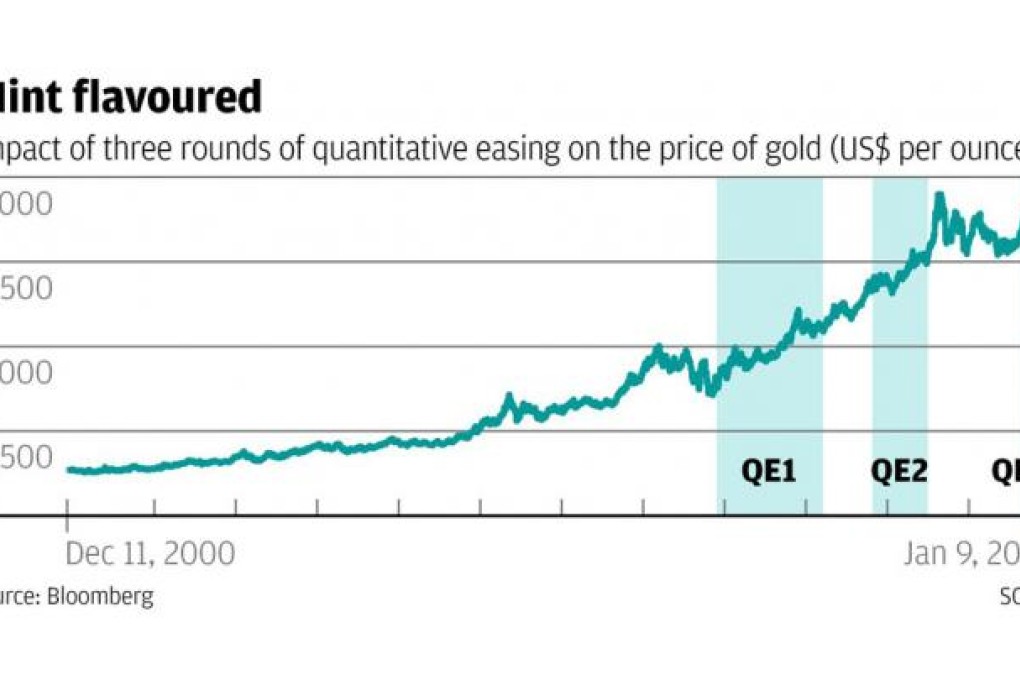

Gold is at a strange juncture. In sharp contrast to the previous two rounds of quantitative easing by the US Federal Reserve, gold prices are trending down, not up (see graph).

Quantitative easing is inflationary. Gold offers protection on inflation. Investors should be buying gold now to guard against QE3-fuelled inflation, but this is not the case.

Why not? Gold prices are largely driven by sentiment. No one has a fundamental need for gold. The annual production of gold is only about 3 per cent of the stock of gold held by investors around the world. Which means any price move in the metal is driven by sentiment, not annual supply and demand.

Sentiment is a fickle thing. Investors cannot be counted on to buy gold even if the circumstances suggest the time is right.

Although gold has had a great run in the past decade, much of it has come in response to the uncertain times unleashed by the global financial crisis, and the liquidity injections and rate cuts in the central bank actions that followed.

The fact that gold did not react positively to QE3 reflects the view that the US economy is recovering. As it picks up, the likelihood of another round of quantitative easing decreases. Already in the minutes of the US Fed meeting held in December last year, discussion has begun about winding down QE3.