Hong Kong stocks log biggest loss in 2 months on China outlook, trade tensions

Stocks slipped amid concerns about China’s economy, US trade ties; Tencent, Orient Overseas and Haidilao lost more than 9 per cent in week

The Hang Seng Index fell 0.9 per cent to 19,064.29 on Friday, bringing the losses over five days to 3.5 per cent, the steepest decline since the November 15 week. The Tech Index dropped 1.2 per cent while the Shanghai Composite Index retreated 1.3 per cent.

Sportswear maker Li Ning tumbled 4.8 per cent to HK$14.82 and China Life Insurance lost 4.4 per cent to HK$13.10, while Alibaba Group slipped 1.2 per cent to HK$79.60. PC maker Lenovo weakened 4.9 per cent to HK$9.34.

Tencent dropped 1 per cent to HK$369.60, failing to hold onto a rebound on Thursday. Separately, the company also cut its stake in merchant services provider Weimob to 2.94 per cent from 8.4 per cent, sinking the latter by 41 per cent to HK$1.88.

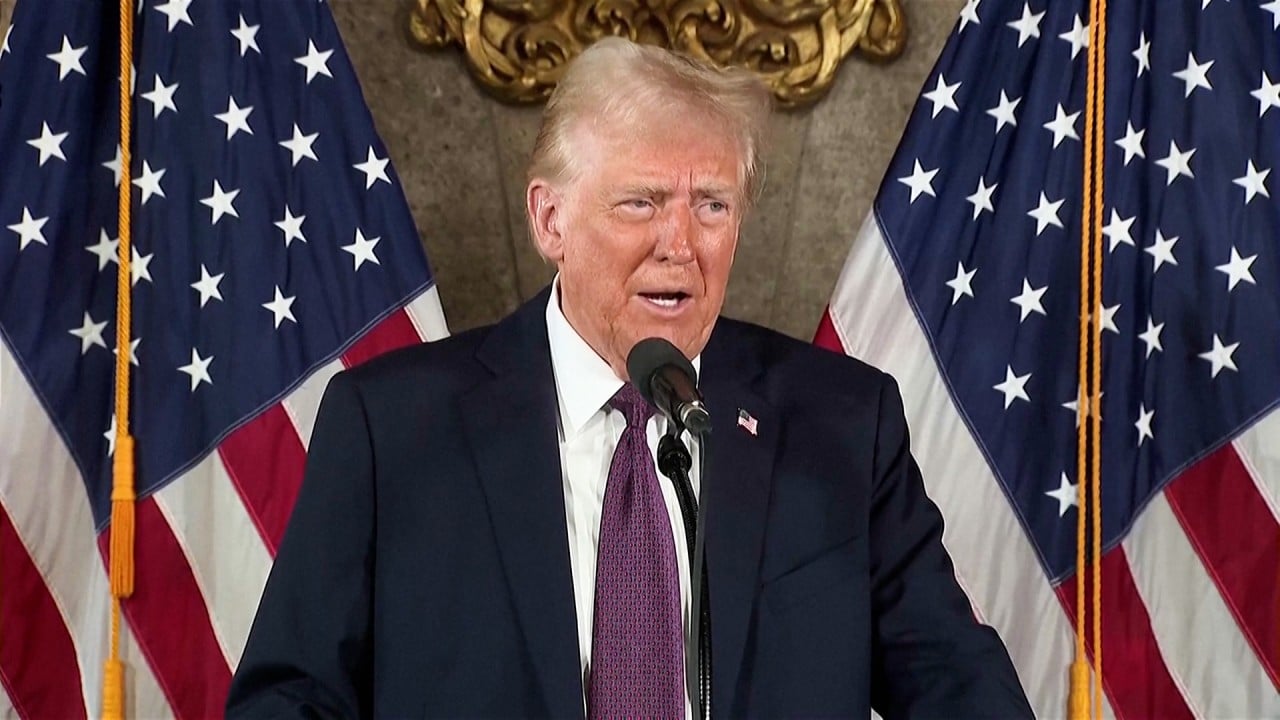

“The first half of the year is likely to be more volatile in terms of stock market performance, especially as US-China bilateral tensions are expected to escalate shortly after the new administration takes office,” said Edith Qian, an analyst at CGS International.

Hong Kong’s stock market lost US$118 billion in capitalisation this week, with Tencent, shipper Orient Overseas and hotpot restaurant chain operator Haidilao suffering more than a 9 per cent sell-off. In China, the central bank said on Friday it would refrain from buying more government bonds, a move seen as an attempt to stem the yuan depreciation.