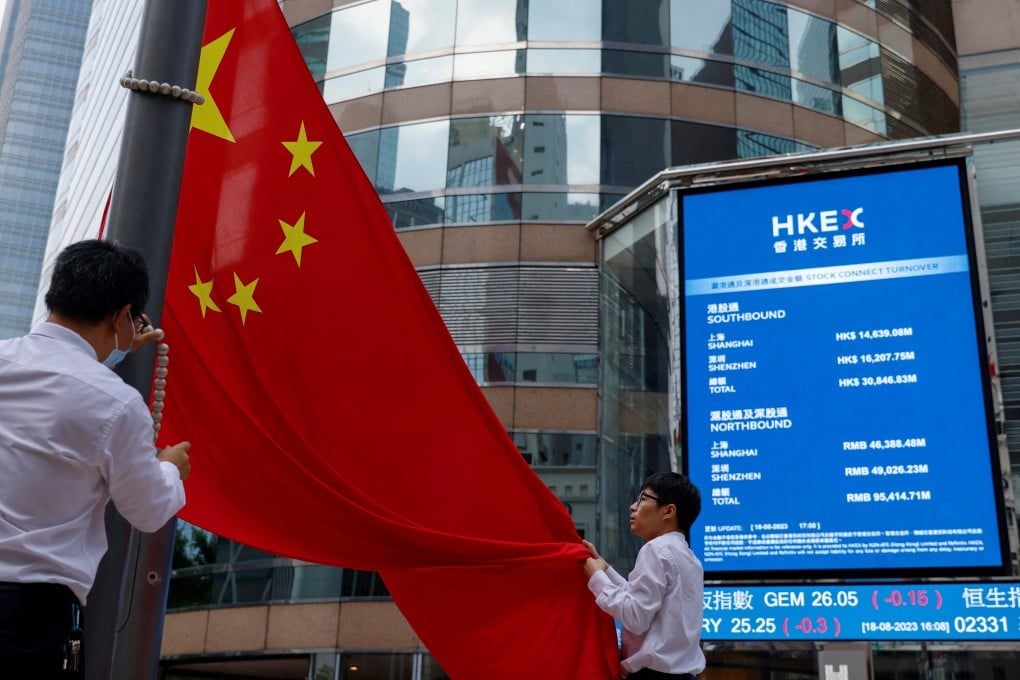

Hong Kong’s SFC Chairman proposes slashing Stock Connect threshold by 80% to draw mainland Chinese funds to city’s market

- Investment threshold for the Stock Connect scheme should be cut to 100,000 yuan (US$13,900) from 500,000 yuan, SFC’s Tim Lui says

- Lui urged mainland regulators to speed up the registration process for Chinese companies seeking to list in Hong Kong and help roll out more trading products

The head of Hong Kong’s securities regulator has proposed lowering the investment barrier for mainland Chinese traders to lift stock market turnover and boost sentiment.

The minimum asset requirement for investing in Hong Kong equities via the southbound leg of the Stock Connect programme should be lowered to 100,000 yuan (US$13,900) from 500,000 yuan, according to one of the two submissions by Tim Lui, chairman of the Securities and Futures Commission (SFC), to the National People’s Congress (NPC), China’s annual parliamentary meeting, in his capacity as a delegate.

Lui was one of 36 delegates from Hong Kong who attended the NPC in Beijing, where they proposed bills on key policies and deliberated on a government work report outlining major economic targets for the year. The political gathering ended on Monday.

He also suggested that the mainland’s market regulator speed up the registration procedure for Chinese companies seeking to list in Hong Kong and assist the city in launching more derivative products tied to yuan assets to strengthen ties.

Lui’s proposals underscore the growing influence of mainland investors since the cross-border Stock Connect scheme, set up in 2014, allowed them access to Hong Kong’s US$4.8 trillion stock market, where a bunch of Chinese tech giants from Alibaba Group Holding to Tencent Holdings are listed and also dominate trading volumes.

Increased participation by onshore investors could boost the valuation of overseas listed companies and help solidify Hong Kong as the third-largest stock market in Asia at a time when foreign investors are moving funds to emerging markets such as India, which is fast closing in on the city in terms of market capitalisation.