Advertisement

China’s offshore bonds watchdog promises easier funds transfer for developers to pay their debt after giving them a tongue lashing

- The NDRC said it would smooth the way to meet borrowers’ ‘reasonable needs’ in debt swaps, registering dollar bonds and remitting foreign currencies to pay their coupons and interests

- The NDRC also subjected the debtors to a tongue-lashing. Borrowers must ‘optimise their foreign debt structure,’ abide by ‘financial discipline and market regulations’ and ‘strictly use the funds raised in accordance with their stated purposes,’ the NDRC said

Reading Time:3 minutes

Why you can trust SCMP

0

China’s overseer of offshore bonds has swung into action, promising easier access to foreign exchange to enable the borrowers of overseas debt to fulfil their obligations, as a string of missed payments turns the final quarter of 2021 into another record period of defaults.

In a meeting with several of the biggest offshore bond issuers,the National Development and Reform Commission (NDRC) said it would smooth the way to meet borrowers’ “reasonable needs” in debt swaps, registering dollar bonds and remitting foreign currencies to pay their coupons and interests, according to a statement.

At the same time, the economic planning authority and watchdog agency of all foreign debt subjected the borrowers to a tongue-lashing. Borrowers must “optimise their foreign debt structure,” abide by “financial discipline and market regulations” and “strictly use the funds raised in accordance with their stated purposes,” the NDRC said.

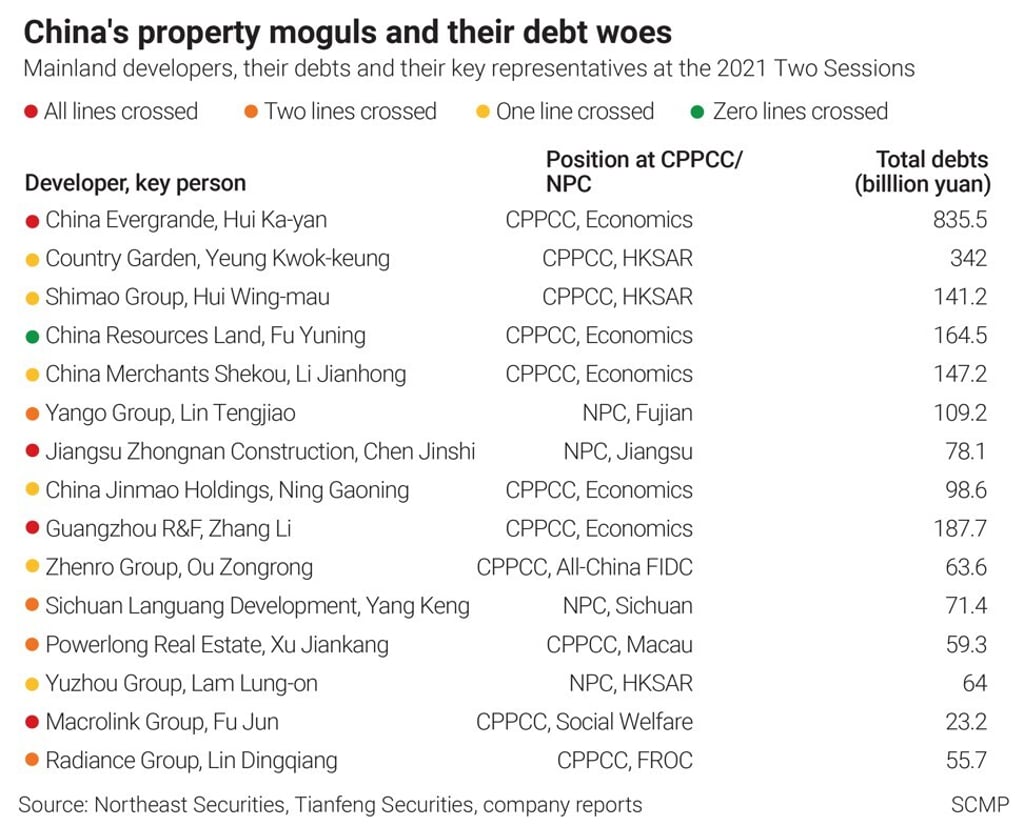

Investors of China’s offshore debt are nervously watching for Beijing’s signals for policy guidance in handling the US$232 billion of offshore bonds, promissory notes and other financial instruments issued by highly leveraged developers, making up almost 9 per cent of the nation’s total foreign debt.

Fitch Ratings last week placed 26 Chinese property developers under observation, as the risk of bond defaults climbed in recent weeks. China Evergrande Group kept investors on tenterhooks after missing an offshore bond coupon, coughing up the US$83.5 million within days of running out on a 30-day grace period to stave off a default.

Other indebted borrowers were less conscientious. Modern Land defaulted on a US$250 million bond on Monday after scrapping a payment plan amid tight liquidity. Fantasia Holdings Group, founded by the niece of former Vice-President Zeng Qinghong, failed to pay US$205.7 million of remaining principal it owed on a US$500 million senior note taken out five years ago and was downgraded to default by all three international credit rating agencies. Sinic Holdings warned two weeks ago that it would default on US$250 million bonds due.

Advertisement