Bank of China’s US$1 billion hole from plunging oil shows how investors and banks alike are ill-prepared for risks of chasing after high returns

- Bank of China’s Crude Oil Treasure product would ultimately burn holes in the pockets of the lender’s retail customers, estimated to total 7 billion yuan

- At least 60,000 people have invested in the product, according to Chinese media

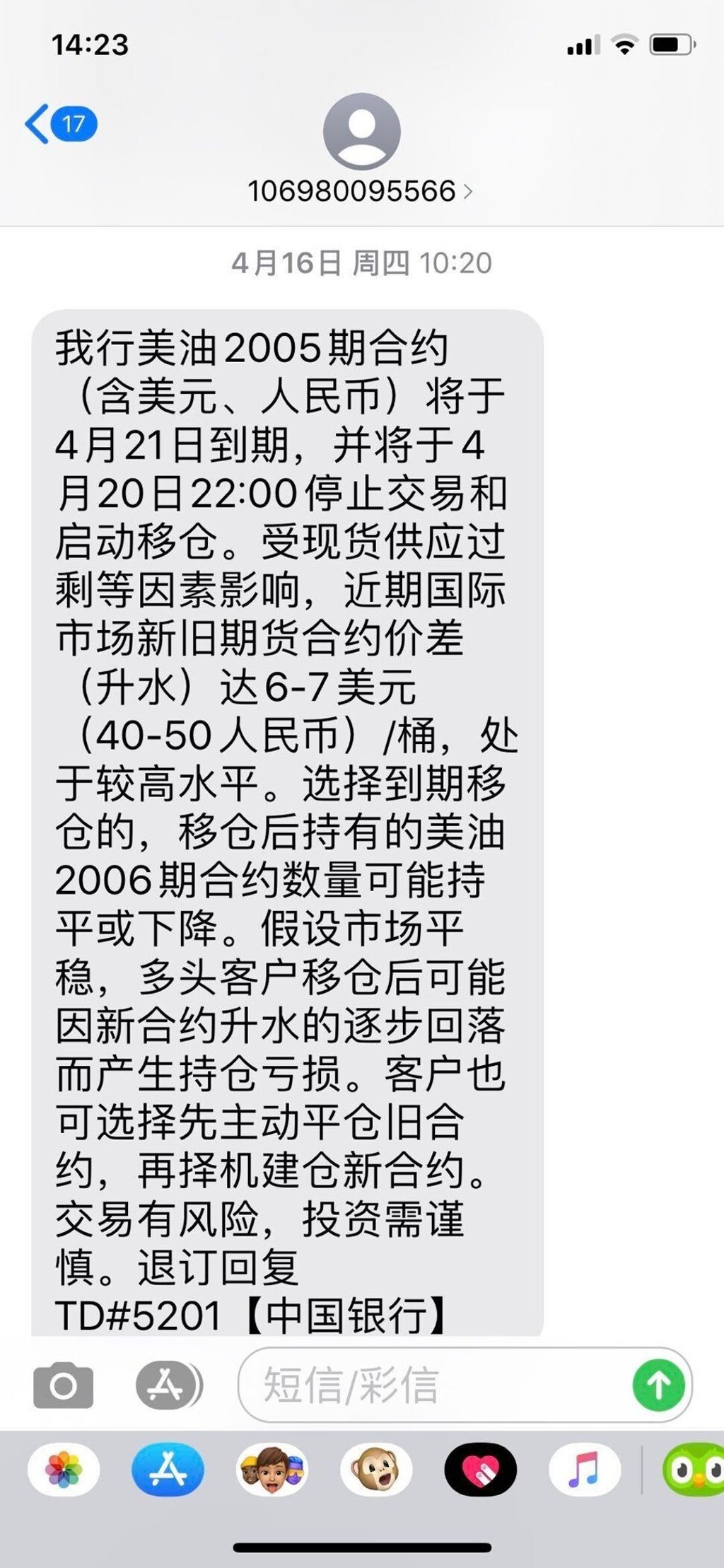

Every day since April 15, David Wang's smartphone would buzz with a message from Bank of China. May contracts for Crude Oil Treasure, a structured financial product that gives the layperson an easy entry into the complex world of oil trading, was expiring in a week, and investors must close or roll over their positions, said the automated message.

Wang dismissed the warnings, and kept going long with 400,000 yuan (US$56,500) of his money at stake, believing that record-low oil prices offered him the chance of a lifetime to get into the market on the cheap.

“This is utterly disheartening and beyond any normal person's comprehension,” Wang said in the Shaanxi provincial capital of Xi’an by telephone, rueing a 1.4 million yuan loss from just two weeks of holding the investment, plus margin credit from the bank.

The brutal loss has far-reaching repercussions across China’s banking industry, as several of the country's biggest state-owned lenders – Industrial and Commercial Bank of China, China Construction Bank, Communication Bank of China, Shanghai Pudong Development Bank – have all hit the pause button on variations of the same structured financial product for their retail customers. The episode exposes the deficiencies in China’s 22.2 trillion yuan wealth management products offered by banks, where regulations and investor protection measures fail to keep up with an industry whose rapid growth had been amplified by technology.