Chinese lenders ready to fight back if profitability is threatened

Mainland lenders are ready to fight back if the likes of Yu E Bao pose a real threat to their profitability

Within just six months, Yu E Bao, the partnership between the mainland's Alibaba and fund house Tianhong Asset Management, raised 250 billion yuan (HK$318 billion) from millions of little guys to invest in money market funds and treasury bonds.

All of a sudden, the market is euphoric about the beginning of the end of the mainland's stodgy and bureaucratic banks. After all, these banks are predominantly state-controlled and have never been nice to the little guys.

If it spreads like wildfire, the regulatory sympathy could evaporate

A sleek new force coming out of nowhere to challenge the entrenched banks is an exciting development.

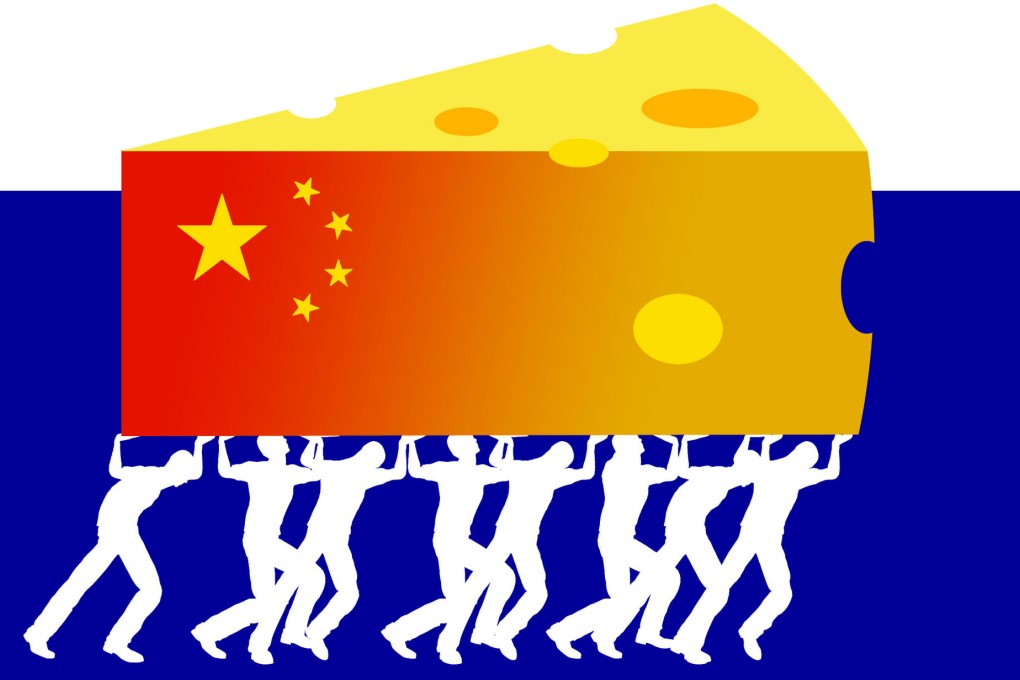

Except that this is just a story. The reality is it is not easy to move the cheese of the banks. Not yet, at least. Let's look at some inconvenient truths.

First, despite the hoopla, the 250 billion yuan is just 0.24 per cent of the banking sector's total deposit base.

Second, none of these e-commerce firms and e-finance platforms has an established base of borrowers or banking skills. They do not even have a lending licence.