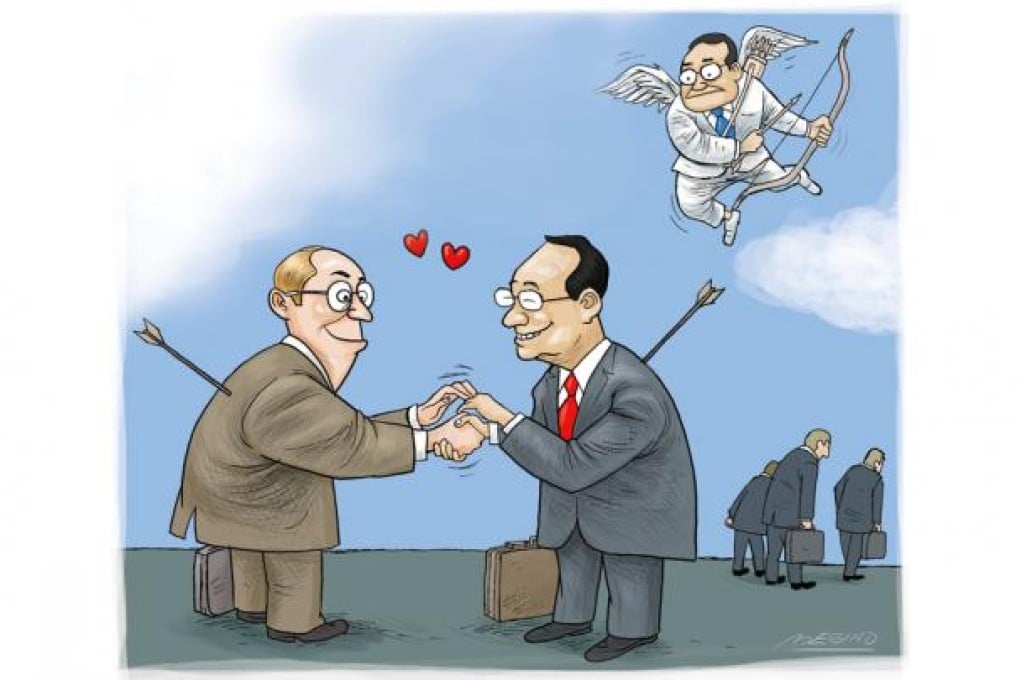

Business Management: China's M&A deals

China's mergers and acquisitions record scores low compared with other countries. How can its buyers avoid losing face?

Chinese companies are increasingly using overseas mergers and acquisitions (M&As) as a way of acquiring new capabilities as they expand globally.

According to a study by Olga Hawn of North Carolina-based Duke University, cross-border deals involving Chinese companies are almost twice as likely to break down (15 per cent of the time) as deals involving fellow so-called BRIC nations of Brazil, Russia and India (8 per cent) and three times as likely as those involving Western multinationals - 5 per cent.

There are a number of reasons for this. Among them, the relatively recent Chinese entry into the cross-border acquisition market, political suspicion of Chinese firms in many target countries, and political issues at home about which companies are allowed to take advantage of growth opportunities. There are also challenges in completing deal funding, and the fact that many Chinese companies are at the forefront of particularly dynamic global markets.

No matter how logical explanation for cancellations, failed deals damage Chinese companies' ability to expand and adapt. While some are unquestionably becoming more sophisticated in making overseas deals, they need to think about how to reduce cancellations once acquisitions are announced.

We present eight key lessons for successful deal making. The first four apply before a specific target is considered; the next four help to assess its viability.