China’s JingDong Industrials eyes US$500 million in Hong Kong IPO, sources say

Firm plans listing as soon as the end of October, according to two sources, after clearing a key regulatory hurdle

The company, also known as JDi, refiled for a Hong Kong listing on Sunday after receiving the green light from China’s securities regulator last week, more than two years after it first notified the China Securities Regulatory Commission of its offering plans, according to the regulator’s disclosures.

The company was planning to launch the offering as soon as possible and complete it in November if it misses a window in October, said the sources, who declined to be identified because the information was confidential.

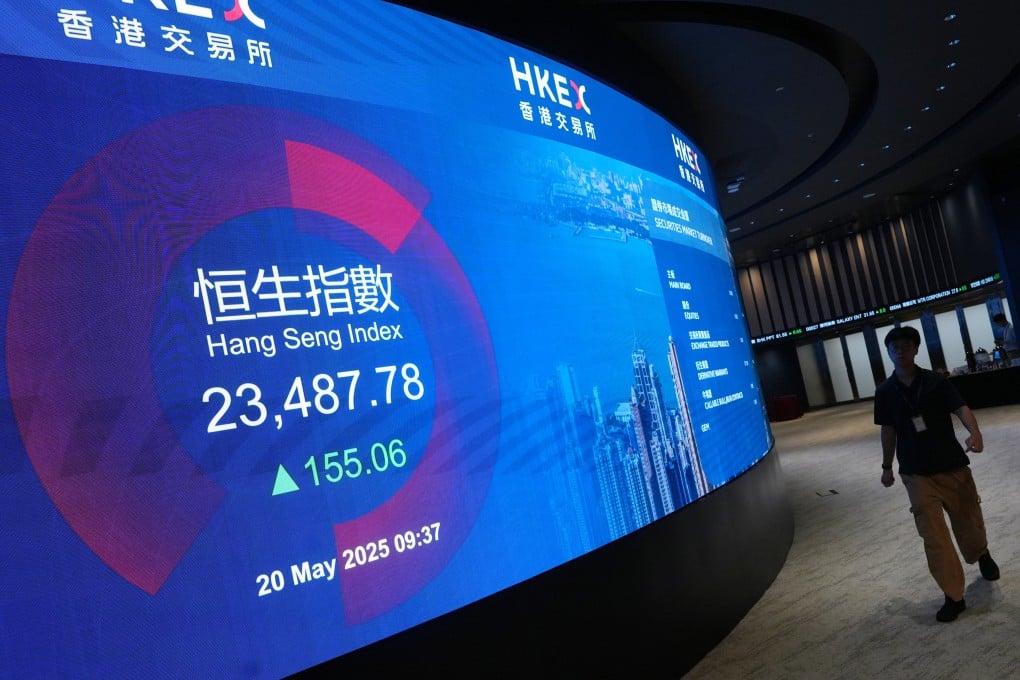

JDi’s long-awaited IPO comes as Hong Kong has experienced a strong recovery in new listings this year, totalling US$23 billion, up more than 200 per cent from a year earlier, according to data from LSEG.

JD.com, which owns about 79 per cent of the unit after spinning it off in 2023, did not immediately respond to a request for comment.

In its Hong Kong IPO filing, JDi said it is the leading industrial supply chain technology and service provider in China.