China Mobile set to raise US$8.78 billion in Shanghai IPO to complete world’s second-biggest stock offering

- China Mobile to price its domestic stock offering at 57.58 yuan per share, raising as much as US$8.78 billion as the world’s second-biggest IPO this year

- Jumbo IPOs by China Mobile and China Telecom have lifted Shanghai Stock Exchange’s ranking above Hong Kong among the world’s busiest IPO venues

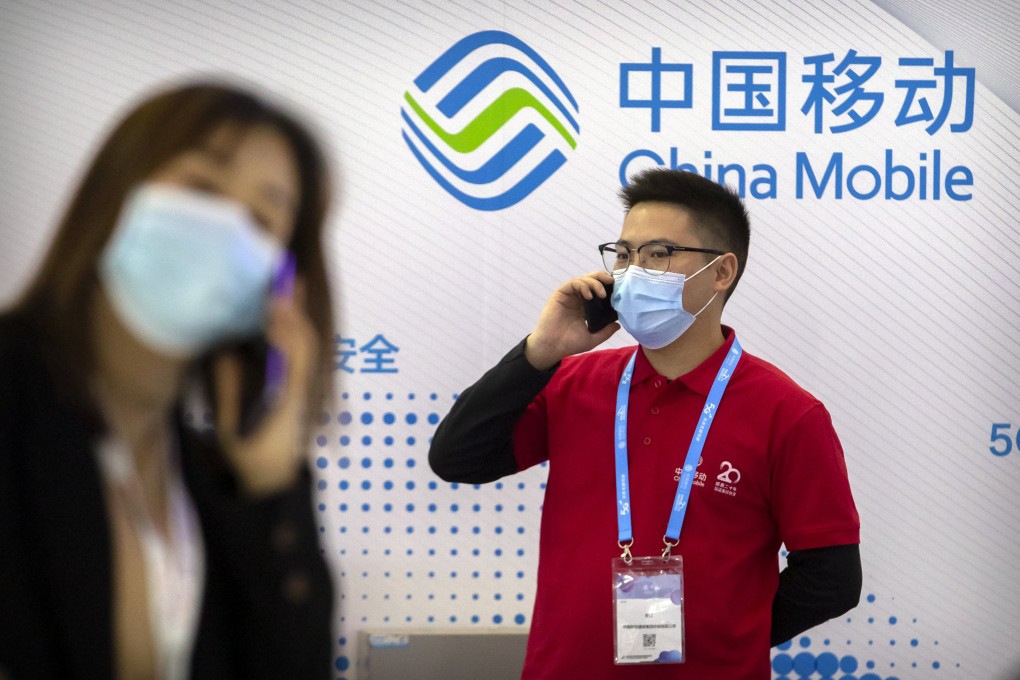

China Mobile is planning what could be the world’s second-largest initial public offering (IPO) this year, almost a year after delisting from the New York Stock Exchange.

The world’s largest mobile network operator by subscribers will sell between 845.7 million and 972.6 million shares, inclusive of an over-allotment option to meet strong investor demand, at 57.58 yuan each in Shanghai, according to an exchange filing. The proceeds of 56 billion yuan (US$8.78 billion) would also rank as the second-largest IPO globally in 2021.

The offer price represents a premium of about 52 per cent over China Mobile’s Hong Kong-listed stock based on its closing price of HK$46.45 on Friday. The stock will trade under the 600941 code in Shanghai.

CICC and Citic are the joint sponsors of China Mobile’s stock offering.