China kicks off national carbon-trading exchange, using market prices to put nation on track to reach 2060 neutrality goal

- The first trade on permits for 160,000 tonnes of emission changed hands at 52.78 yuan a tonne, according to state media CCTV

- Trading is initially limited to the power-generation sector, which contributes about 40 per cent to carbon dioxide pollution

The first permit for 160,000 tonnes of emissions was transacted at 52.78 yuan a tonne on Friday morning, with the total trading volume reaching 7.9 million yuan, according to China Central Television, without divulging the identities of the buyers and sellers.

About 2,200 key emission units in the power generation industry are included in the national emission trading market, with more than 4 billion tonnes in combined carbon dioxide emissions, Xinhua News Agency reported at the debut trading officiating ceremony.

03:27

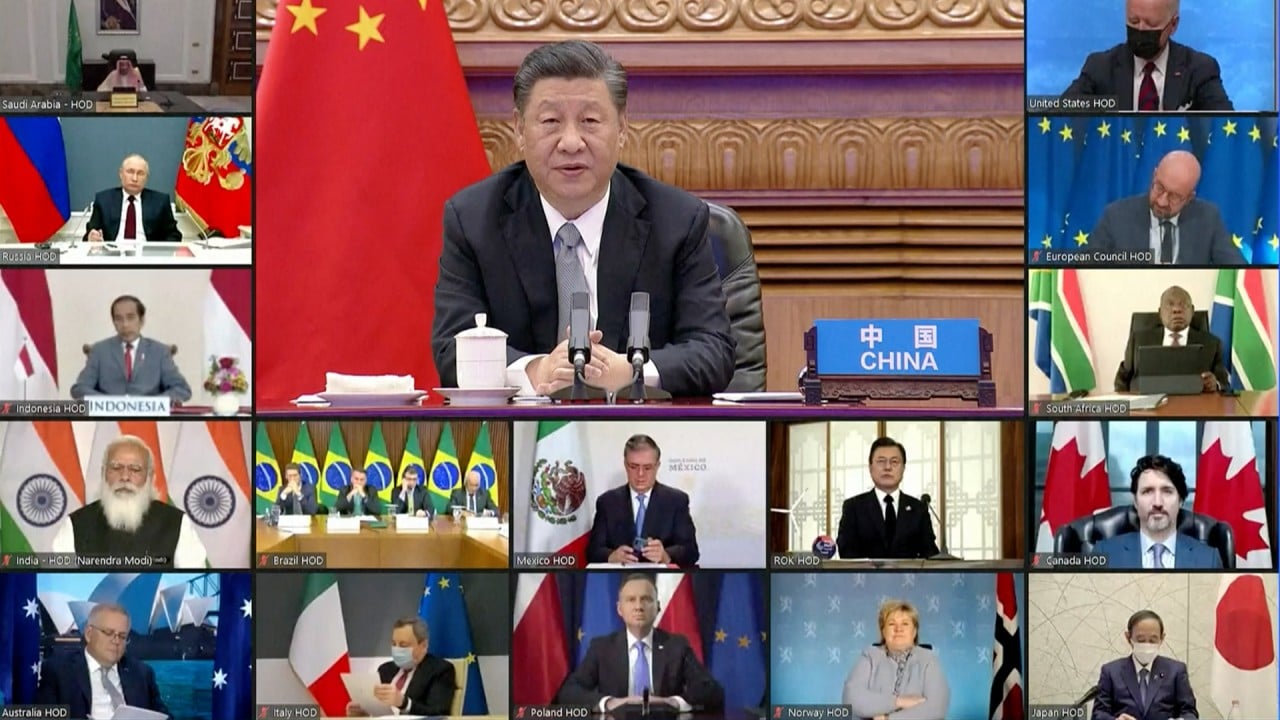

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

Less efficient companies, whose emissions exceed their quotas, will have to square the difference by buying additional permits from more efficient companies whose emissions are less than their allocations.