US Treasury takes no action on major banks in Hong Kong crackdown, providing relief for Citi, HSBC and other lenders

- The US Treasury Department said it has not identified any foreign financial institutions that have “knowingly conducted a significant transaction” with sanctioned individuals

- Treasury will continue to monitor for any activity that meets these criteria,” and would keep engaging foreign governments, the report said

The United States government said it had not identified any global banks that “knowingly” did business with several officials on a US sanctions list over the Chinese government’s enactment of the national security law for Hong Kong.

“At this time, Treasury has not identified any FFI [foreign financial institutions] that has knowingly conducted a significant transaction with a foreign person” identified by the US State Department, the Treasury report said. “Treasury will continue to monitor for any activity that meets these criteria,” and would keep engaging foreign governments and foreign financial institutions over the topic, the report added.

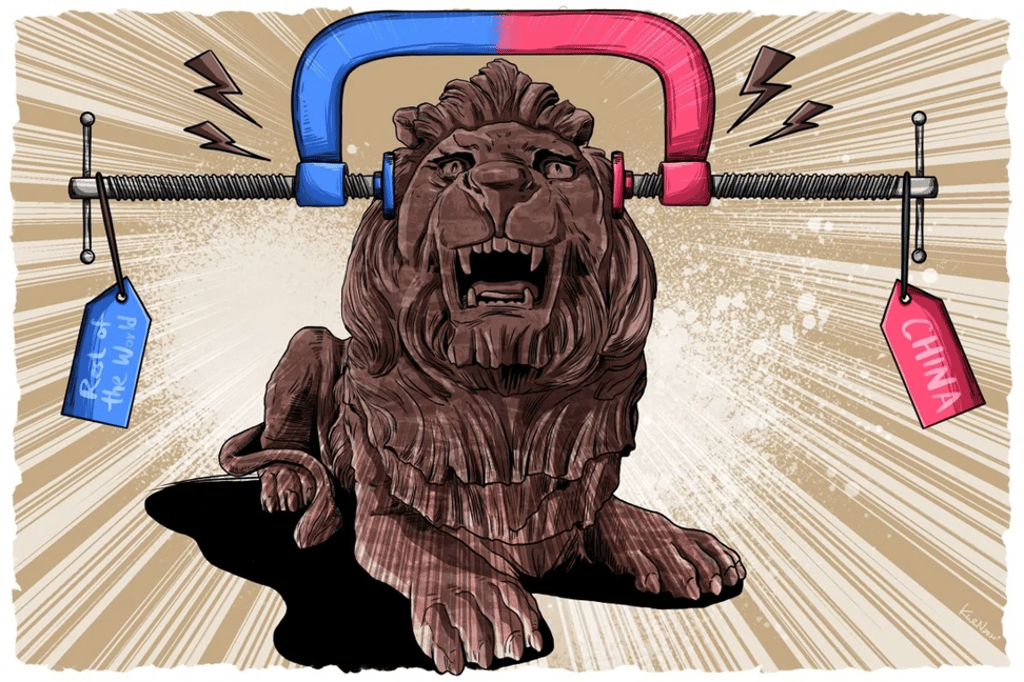

The move is likely to come as a relief to major lenders and financial institutions such as Bank of China, Citigroup, HSBC and Standard Chartered, that have been trying to distance themselves from those sanctioned officials amid the controversial national security law passed for Hong Kong. HSBC, Standard Chartered and Bank of China’s Hong Kong unit - the city’s three currency issuers - are particularly precarious as they are also among the largest local lenders, counting sanctioned officials among their customers.

“The Treasury Department will only identify FFIs that knowingly conduct a significant transaction with a foreign person identified” to have undermined Hong Kong’s freedoms, it said, adding that under US law, the report on foreign financial institutions in violation will be completed within 60 days.