Why US interest rates aren't going higher any time soon

While recent data looks encouraging, the US economy remains weak and vulnerable, which is why the Fed won't raise interest rates anytime soon

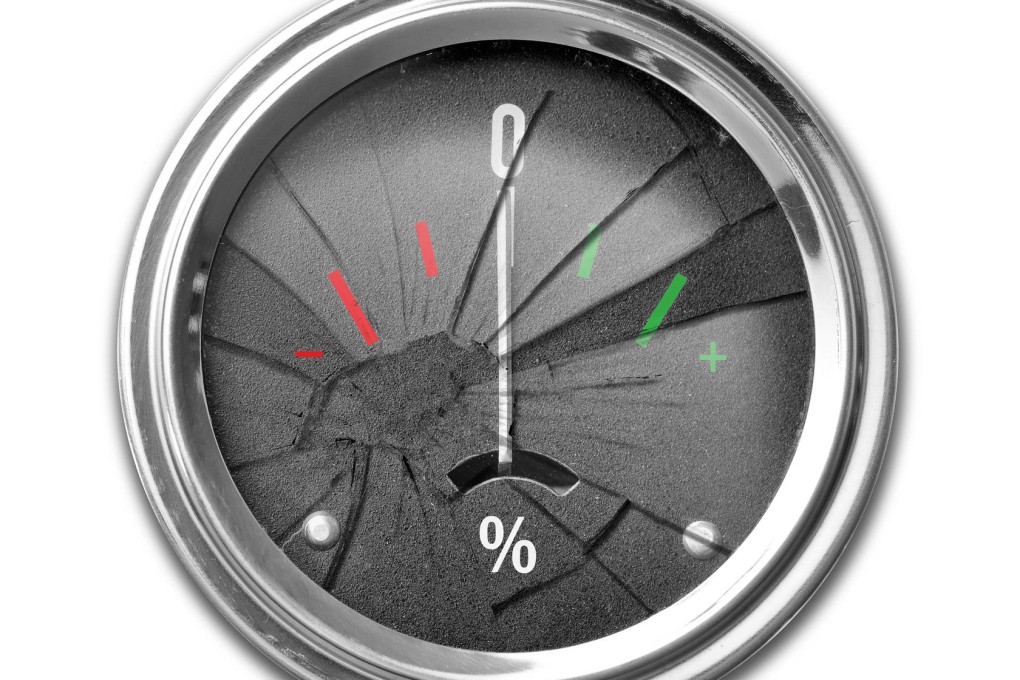

Financial markets have been primed for about a year now to expect higher US interest rates. They haven't arrived yet and probably won't until well into 2016.

Don't be fooled into thinking that the tapering of the Federal Reserve's massive asset purchase programme heralds the imminent normalisation of monetary policy.

The massive distortions created by the Fed's interest rate manipulations will be with us for far longer than most analysts anticipate. Why? Because the American economy is still in the midst of the Great Recession.

Recent data looks encouraging, but the US economy remains weak and vulnerable. Aggregate demand, as measured by final sales to domestic purchasers, tells the tale.

When … Volcker … pushed interest rates up, the opportunity cost of holding cash increased

The annual trend rate of growth in nominal aggregate demand has been 4.95 per cent since 1987. At the depth of the Great Recession, that plunged to an annual rate lower than minus 4 per cent.