Everbright to double size of Hong Kong share sale

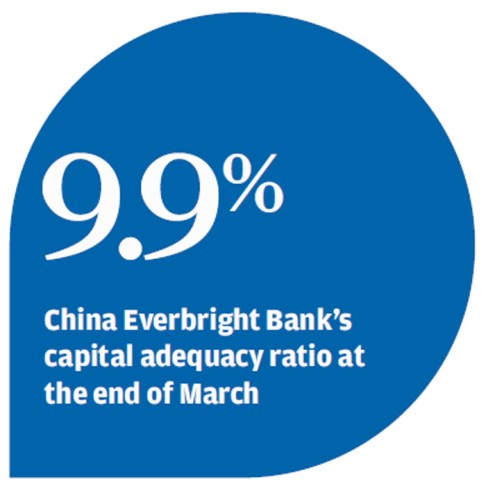

Twice-delayed float expected to be increased to US$4 billion to help Beijing-based bank meet higher capital adequacy requirements

China Everbright Bank, which is preparing for its third official listing attempt, plans to double the size of its long-planned Hong Kong offering to up to US$4 billion by selling 12 billion shares.

The Beijing-based lender has mandated investment banks CICC and Morgan Stanley to take lead roles in arranging the share sale and gauge investor feedback, after it resubmitted its listing application to the exchange last week.

The share stake put up in the float is set to be 25 to 30 per cent of the total, up from about 15 per cent last year, when the bank had secured more than US$1 billion from cornerstone investors. It was reported that Everbright was seeking a US$2 billion listing.

A significant rise in the benchmark 10-year US treasury yields prompted the cash-strapped bank to issue more shares, as the cost of funding was inevitably on an upward trend, a banker said.

"Poor market conditions and investors' scepticism over new shares have increased the difficulty for Everbright's IPO," he said. "Valuation of the shares is the only key to its Hong Kong listing, as it must take at least a 10 per cent discount to its A shares."