Nio lidar supplier Seyond soars in Hong Kong debut after HK$1 billion de-SPAC merger

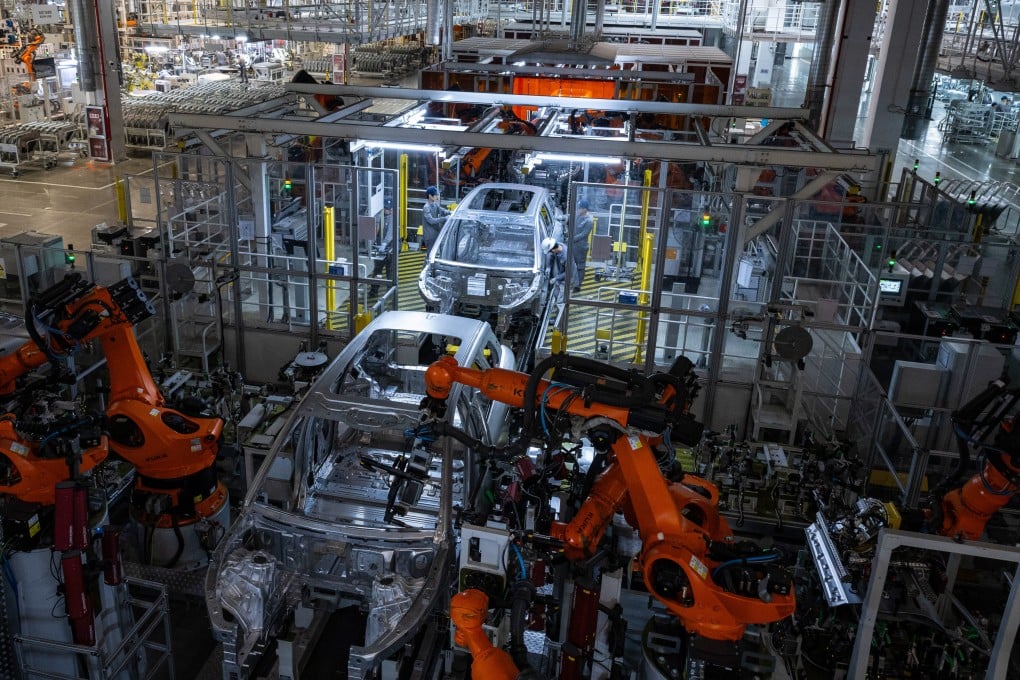

Its lidar sensors are used by carmakers such as Nio, as well as in robotics, unmanned delivery and industrial automation scenarios

Nio’s lidar supplier Seyond Holdings debuted on the Hong Kong stock exchange on Wednesday, through a de-SPAC transaction, merging with special purpose acquisition company TechStar Acquisition and raising a total of HK$1.03 billion (US$132.4 million).

The Silicon Valley-based company, which designs, develops and produces light detecting and ranging sensors for advanced driver assistance systems (ADAS), saw its shares – issued at HK$10 each – jump as high as HK$17.30 in morning trading before closing at HK$13.30.

The company was founded in 2016 by former Baidu engineer Bao Junwei, who received his bachelor’s degree from Peking University and PhD from the University of California, Berkeley, and his Peking University alumnus Li Yimin. Both worked at Baidu’s autonomous driving unit before starting the firm, which was initially called Innovusion.

Seyond has research and development centres in Silicon Valley, Suzhou and Shanghai, and manufacturing bases and testing facilities in Jiangsu, Zhejiang and Jiangxi provinces. Its lidar sensors are used in ADAS by carmakers such as Nio, as well as in robotics, unmanned delivery and industrial automation scenarios.

In 2024, the company delivered around 230,000 automotive-grade lidar systems, ranking fourth globally in terms of revenue for ADAS lidar, with a market share of 12.8 per cent, according to consultancy firm CIC.

Since its founding, the company has received investments from Nio Capital, Hermitage Capital, Temasek and Fidelity Investments.