China must refocus renewable energy investment to distribution from generation: Natixis

Natixis says China’s power-equipment industry needs to shift its investment focus to storage and distribution infrastructure

“China’s investment in green energy technology is so massive that even in the worst scenario of energy transition, it will be enough to meet its own needs and maintain its [dominant] share in the global renewable equipment market for a long time,” Alicia Garcia Herrero, the bank’s chief economist for the Asia-Pacific region, said on Wednesday.

“There are other technologies where China can expand within the green space that will allow its industry to still invest without overcapacity risk.”

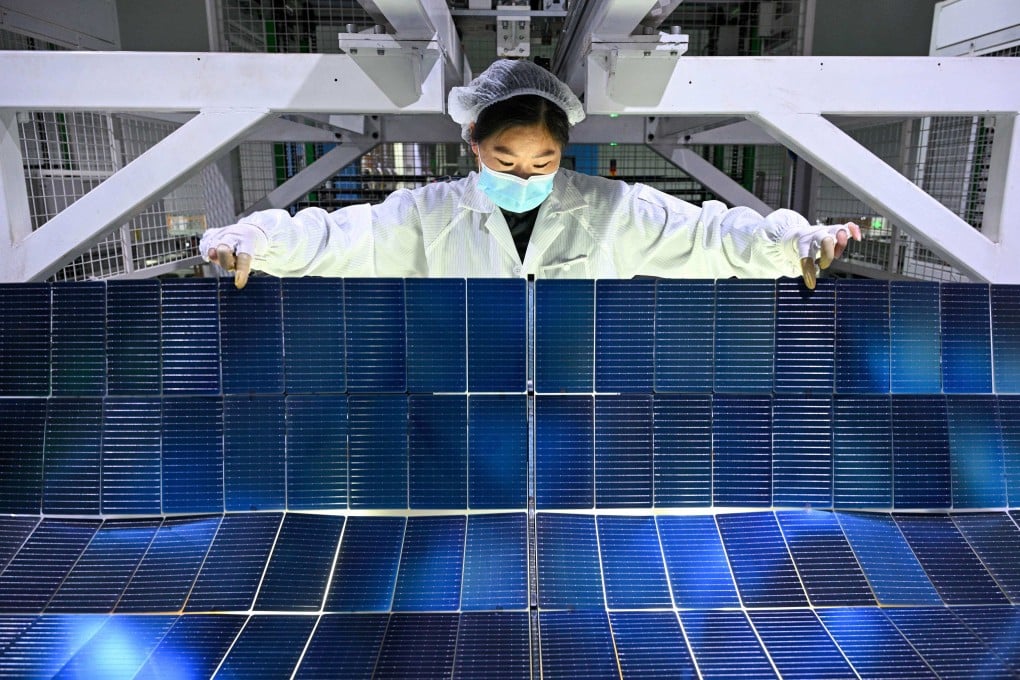

Last year, China’s solar-panel output exceeded global demand, resulting in an inventory glut in the European Union – its biggest market – said Mu Haoxin, a Natixis economist.

Investment in power generation doubled to 1.2 trillion yuan (US$165 billion) last year from 2021, which dwarfed the amount of money that went into the power grid over the same period, Mu said. This meant that the industry needed to fill a large gap to ease grid bottlenecks.

According to China’s National Energy Administration (NEA), as installations of solar farms surged 27.8 per cent last year, the amount of generated but unused solar energy due to grid bottlenecks rose to 3.2 per cent from 2 per cent. For wind power, it rose to 4.1 per cent from 2.7 per cent.