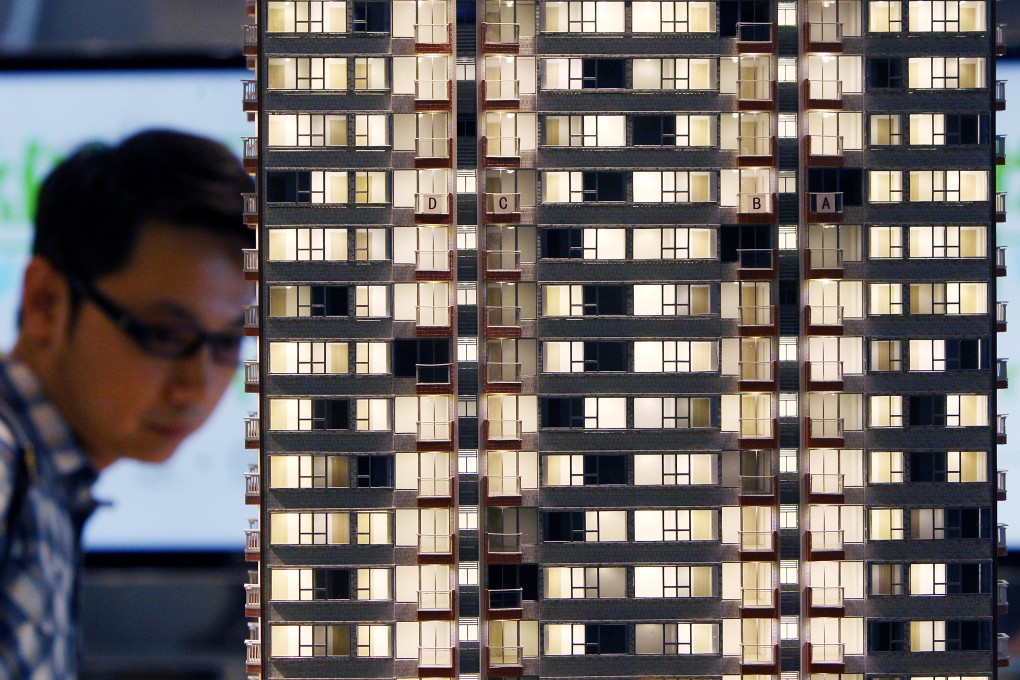

Hong Kong’s third-quarter negative-equity cases jump 34% to a 21-year high of 40,713

The jump in cases is ‘no cause for concern’ as the repayment ability of Hong Kong owners remains stable, a local mortgage broker says

Hong Kong’s mortgage borrowers find themselves in increasingly dire straits, as the worth of their property is falling faster than the value of their loans, according to the latest data released by the city’s monetary authority.

The aggregate value of residential mortgage loans in negative equity increased to HK$207.5 billion at end-September, compared with HK$155 billion in the previous quarter.

The jump is due to a nearly 30 per cent decline in home prices from their peak in 2021, which “fell through both the 10 per cent and 20 per cent threshold”, said Ivy Wong Mei-fung, managing director of Centaline Mortgage Broker. “As a result, some high loan-to-value ratio mortgages of up to 90 per cent in recent years have also dropped into negative equity.”

Hong Kong’s lived-in home prices fell by about 1.7 per cent in September to their lowest level since August 2016, as the impact of interest-rate cuts has yet to filter through to the faltering property sector.