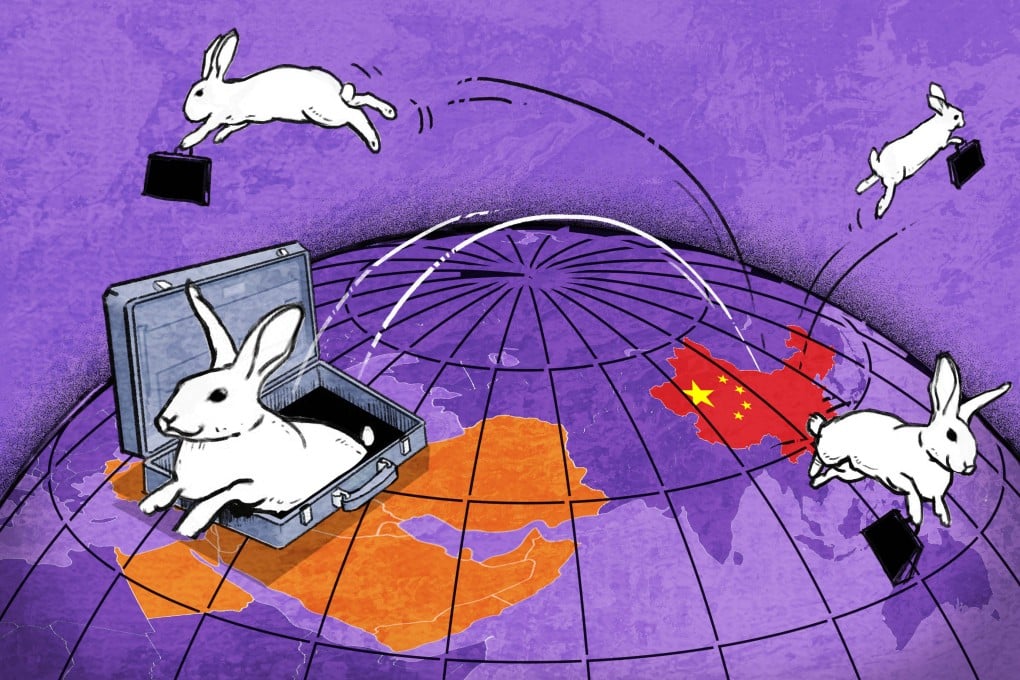

FII Priority: Ray Dalio’s ‘smart rabbit with 3 burrows’ hedge shows Chinese executives the way to navigate Middle Eastern markets

- The recent wave of Chinese companies expanding in the Middle East share a common thread: their focus on technology and innovation

- Their expansion comes at a time when several Middle Eastern countries are seeking to diversify their oil-dependent economies.

One late-October morning in one of the most expensive hotels in Saudi Arabia’s capital Riyadh, a group of Chinese start-up entrepreneurs and mainland financiers was reminded of the importance of preparedness and proactive backup plans by Ray Dalio, the founder of the world’s biggest hedge fund firm, Bridgewater Associates.

Attendees at the event networked with major Saudi executives from Aramco, the world’s largest oil company, to Public Investment Fund (PIF), the kingdom’s US$700 billion sovereign wealth fund.

Dalio’s hedging tip in Riyadh emerges when the global economy is grappling with market uncertainties and geopolitical tensions. It immediately struck a chord with the audience, evoking both applause and laughter after the humorous and appropriate use of the rabbit analogy. But on a more sombre note, Dalio’s words underscored the need for investors to diversify their portfolios given the inherent instability of the global economy, and the repercussions of the Ukraine invasion and the Israel-Gaza war.

Bill Huang Xiaoqing, the founder and CEO of Shanghai-based AI powered robot developer Dataa Robotics, was in the audience that day and said the advice was timely.