Evergrande, Kaisa and other indebted developers get a break as China’s rate cuts release funds to relieve their cash crunch and mounting debt

- The Hang Seng Mainland Properties Index, which tracks the performance of property developers traded on the Hong Kong stock exchange, rose by as much as 5.2 per cent

- China Evergrande Group, Kaisa Holdings, Sunac China Holdings and other Chinese developers all soared

China’s publicly traded developers soared on the stock market, as the first cut in mortgage rates in two years combined with a government plan to grant them easier access to sales receipts brought much-needed relief to their cash crunch and mounting debt.

The Hang Seng Mainland Properties Index, which tracks the performance of property developers traded on the Hong Kong stock exchange, rose by 4.6 per cent to close at 4,640.74 points.

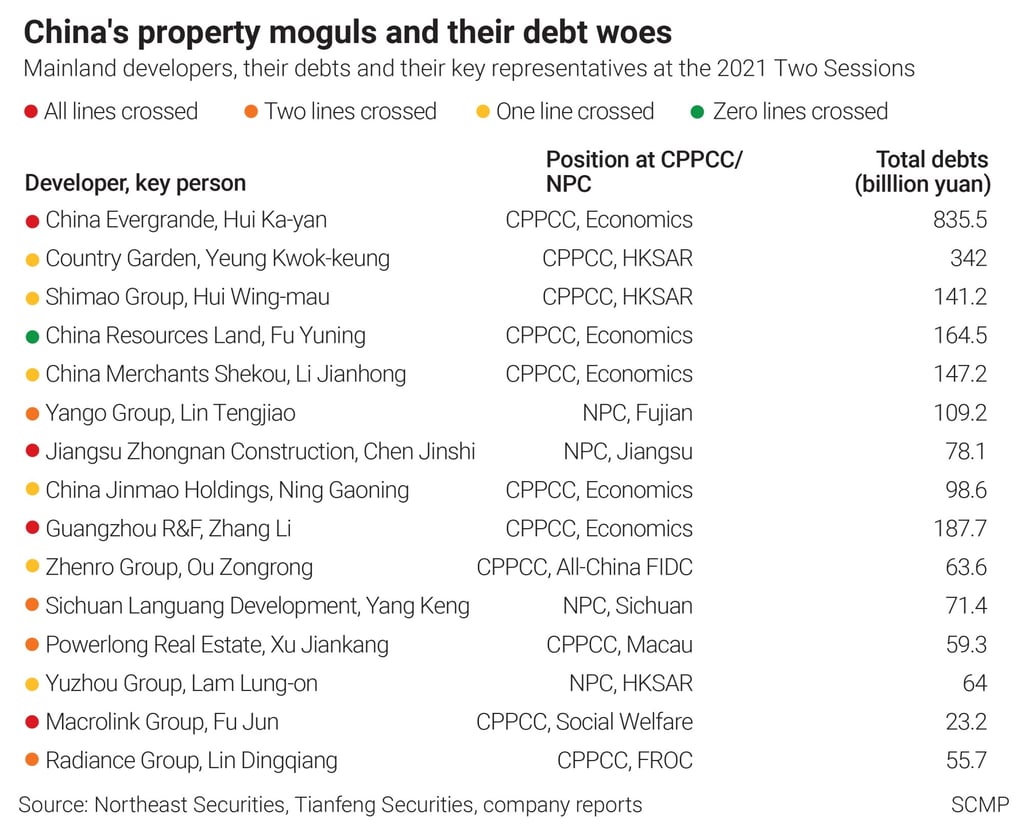

Sunac China Holdings, one of the country’s most leveraged developers, led the surge, with its shares jumping by 14.6 per cent. Shimao Group Holdings, founded by the developer Hui Wing Mau, advanced 12.1 per cent. Country Garden Group rose 4.4 per cent, while the shares of Chongqing’s Longfor Group increased by 2.4 per cent.

“Monetary loosening is necessary, considering that real estate is a slow variable and it may take time for fiscal expansion to become effective,” CICC analysts led by Huang Wenjing wrote in a report. “The cycle of lowering reserve requirement ratios and interest rates has started, rather than coming to an end.”